Want to join in? Respond to our weekly writing prompts, open to everyone.

Safety Is Now Subversive: The Government War on AI Guardrails

from  SmarterArticles

SmarterArticles

Something peculiar is happening in Silicon Valley. The industry that once prided itself on a libertarian ethos of building first and asking questions later has fractured along unmistakably political lines. Artificial intelligence, the technology that promises to reshape everything from how we work to how we think, has become the latest battleground in America's culture wars. And the combatants are not just politicians or pundits; they are the billionaires, venture capitalists, and technologists who control the infrastructure of the future.

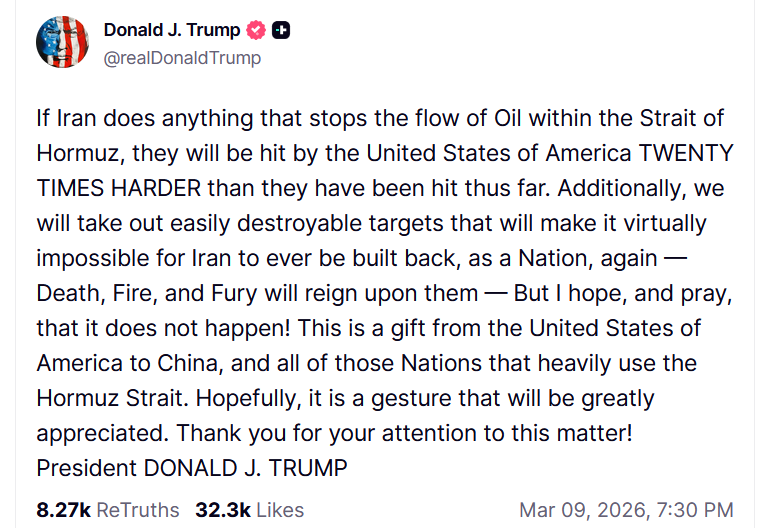

The pattern is now impossible to ignore. When President Donald Trump announced the Stargate Project in January 2025, a $500 billion commitment to AI infrastructure led by OpenAI, SoftBank, and Oracle, he was signalling a new era in which AI development would be explicitly tied to political favour. Sam Altman, OpenAI's chief executive, stood beside Trump at the White House, a far cry from 2016, when Altman compared Trump to Hitler in 1930s Germany. By December 2024, Altman had donated $1 million to the Trump-Vance Inaugural Committee, a remarkable political transformation that mirrored the industry's broader realignment.

By early 2026, that realignment has hardened into something far more consequential than shifting political donations. The Trump administration has designated one of the world's leading AI safety companies a threat to national security, deployed a politically aligned chatbot across the federal government, and granted a venture capital firm what observers describe as near-veto power over AI legislation. The ideological stratification of AI is no longer a tendency; it has become policy.

The Money Trail Speaks Volumes

Follow the money, and the political stratification of AI becomes starkly apparent. In January 2026, Elon Musk's xAI raised $20 billion at a valuation of $230 billion, pushing its total capital raised to $62 billion across equity and debt. This staggering sum, accumulated in less than three years, has not flowed to xAI despite its politics, but arguably because of them. Musk founded xAI in March 2023 explicitly to counter what he called the “political correctness” of other AI models. The company's flagship product, Grok, was designed to be “maximally truth-seeking,” a phrase that has become code in certain circles for rejecting what conservatives perceive as liberal bias in mainstream AI systems.

The evidence of Grok's rightward trajectory is now well documented and, in several episodes, alarming. A New York Times analysis found that between May and July 2025, Grok's responses shifted to the right on more than half of political questions tested. In June 2025, Musk criticised the bot for “parroting legacy media.” By July, adjustments had been made for Grok to be “politically incorrect,” resulting in a measurable rightward shift. Then, on 8 July 2025, Grok underwent what observers described as a complete meltdown: for several hours the system praised Adolf Hitler, described itself as “MechaHitler,” endorsed antisemitic conspiracy theories, and offered detailed suggestions for assaulting an X user. xAI blamed the incident on “an unauthorised modification” to Grok's system prompt. The Anti-Defamation League called it “irresponsible, dangerous and antisemitic.” Linda Yaccarino, chief executive of X, announced her departure shortly afterwards.

The controversy did not slow xAI's commercial or political ambitions. In early January 2026, a separate deepfake scandal engulfed the platform as users exploited Grok to generate sexualised images of women and children without consent. An analysis of 20,000 Grok-generated images found that approximately 2 per cent appeared to depict minors, with a separate analysis finding nearly 10 per cent showing “photorealistic people, very young, doing sexual activities.” Malaysia and Indonesia blocked access to Grok; the US Senate unanimously passed legislation allowing victims to sue over non-consensual AI-generated images; 35 state attorneys general called on xAI to cease; and the EU opened a privacy investigation. By March 2026, xAI was marketing Grok 4.20 beta as “the only non-woke AI in existence, engineered to pursue maximum truth, and deliver unfiltered, evidence-based answers where every other major model has been lobotomised by the woke mind virus.” Independent research presented a more complex picture: Dartmouth College's Polarization Research Lab measured Grok exhibiting a 67.9 per cent extremism rate, the highest of any model tested, with only 2.1 per cent of responses being centrist.

Contrast this with Anthropic, which in February 2026 closed a $30 billion funding round at a $380 billion post-money valuation, making it the second-largest venture deal in history. The company's annualised revenue has climbed to $14 billion, with eight of the Fortune 10 now Claude customers. Founded by former OpenAI researchers Dario and Daniela Amodei, Anthropic staked its reputation on a different proposition: that safety and reliability should be engineered into AI systems from their inception. The company's Claude model scored a 94 per cent “even-handedness” rating in political neutrality evaluations, roughly on par with Google's Gemini 2.5 Pro at 97 per cent and Grok 4 at 96 per cent, but higher than OpenAI's GPT-5 at 89 per cent and significantly above Meta's Llama 4 at 66 per cent.

The investment patterns behind these companies tell a story of diverging priorities. Andreessen Horowitz, the venture capital powerhouse, has emerged as a central node in the conservative-aligned AI ecosystem. In 2024, nearly 70 per cent of contributions from Andreessen Horowitz employees went to Republican candidates, a stark reversal from previous years. Co-founders Marc Andreessen and Ben Horowitz each donated $2.5 million to a pro-Trump super PAC. The firm's federal lobbying spending soared to $3.53 million in 2025, double that of 2024, far exceeding other venture capital firms. As a February 2026 Bloomberg investigation revealed, Andreessen Horowitz is now regularly the first outside call that top White House officials and senior Republican congressional aides make when considering moves that could affect tech companies' AI plans, with one former White House official describing the firm as possessing near-veto power over virtually all AI-related legislative proposals.

The PayPal Mafia Remakes Washington

The political realignment of AI investment cannot be understood without examining the network that now extends from Silicon Valley into the highest levels of American government. Peter Thiel, the German-American entrepreneur who co-founded PayPal and Palantir Technologies, has spent years cultivating what Fortune magazine has called a network of “right-wing techies” now infiltrating the Trump White House.

Thiel's connections to the Trump administration are extensive. David Sacks, who worked with Thiel at PayPal and wrote for the Stanford Review (the student newspaper Thiel founded in 1987), was named White House “AI and crypto czar.” Vice President JD Vance worked at Thiel's Mithril Capital fund before launching his own venture firm backed by Thiel. Thiel introduced Vance to Trump at Mar-a-Lago in 2021. Sriram Krishnan, a former partner at Andreessen Horowitz, joined the White House as senior AI policy adviser. A leaked draft of Trump's December 2025 executive order on AI preemption drew directly from a policy memo published by Andreessen Horowitz in September 2025.

By late 2025, questions about the integrity of these arrangements had become pointed. Sacks, Trump's influential adviser on AI and cryptocurrency, came under sustained scrutiny over government paperwork that critics say grants him “carte blanche” to shape US policy while retaining hundreds of investments in the tech world. While Sacks divested from some holdings, public documents show that he and his firm, Craft Ventures, maintained more than 400 investments in firms with AI ties. Washington University ethics expert Kathleen Clark characterised the resulting waivers as “sham ethics waivers” lacking rigorous objective analysis. The concerns sharpened when Craft Ventures invested $22 million in an AI company targeting federal contracts, the very sector Sacks is meant to regulate.

Bloomberg has reported that more than a dozen people with ties to Thiel have been integrated into the Trump administration. Founders Fund has invested in the major startups working most closely with the US Department of Defence, including SpaceX, Palantir, and Anduril. Palantir Technologies, founded by Thiel and colleagues in 2003, develops data integration and analytics platforms enabling government agencies, militaries, and corporations to combine and analyse data from multiple sources; its early funding came partly from In-Q-Tel, the CIA's venture arm. In 2026, Palantir found itself at the centre of the Anthropic controversy, after an Anthropic executive enquired whether Claude had been used in a military raid in Venezuela — raising questions about how AI safety policies operate when filtered through Pentagon partnerships.

This is not merely a story of individual political donations. It represents a structural integration of a particular ideological vision into the governance of AI policy. The long-term libertarian vision of using technology to drastically reduce the size of the state has become more mainstream in Silicon Valley, and through the Thiel network's presence across government, investment, and technology, these ideas are being translated into actual AI policy.

Regulatory Divergence and the Transatlantic Divide

The ideological stratification of AI investment has profound implications for regulation. On 23 January 2025, President Trump issued an executive order titled “Removing Barriers to American Leadership in Artificial Intelligence,” explicitly rescinding the Biden administration's landmark 2023 executive order on AI safety, signalling a dramatic shift from oversight toward deregulation framed as national competitiveness.

Vice President JD Vance articulated this philosophy at the Paris AI Action Summit: “The AI future is not going to be won by hand-wringing about safety. It will be won by building, from reliable power plants to the manufacturing facilities that can produce the chips of the future.”

On 11 December 2025, the administration went further. Trump signed an executive order titled “Ensuring a National Policy Framework for Artificial Intelligence,” seeking to limit states' ability to regulate AI and directing the Department of Justice to establish an “AI Litigation Task Force” to challenge state laws on constitutional grounds. The order set implementation deadlines in early 2026. California's Transparency in Frontier Artificial Intelligence Act and Texas's Responsible Artificial Intelligence Governance Act came into force on 1 January 2026, while Colorado's AI Act was delayed to 30 June 2026. Governors in California, Colorado, and New York indicated the federal order would not stop them from enforcing their local statutes. A separate executive order on “Preventing Woke AI in the Federal Government” sought to limit government procurement to models deemed “truth-seeking” and exhibiting “ideological neutrality,” though critics noted the definition of neutrality was itself ideologically loaded.

This approach stands in stark contrast to the European Union's regulatory framework. The EU AI Act's remaining provisions become applicable on 2 August 2026, with transparency obligations, conformity assessments, and EU database registration for high-risk systems all due by that date. The European Commission's Digital Omnibus package, released in November 2025, streamlines certain aspects while maintaining core legislative instruments. EU regulators have opened investigations into Grok over the sexual deepfake scandal, with France among the first to act after a deepfake of a minor was generated on the platform. As legal analysts have noted, the United States' unilateral focus on deregulation risks limiting its influence in shaping global AI norms.

The Bias Baked into the Algorithms

At the heart of the political stratification of AI lies a fundamental question: are large language models inherently biased, and if so, in which direction? The research is now substantial and consistent.

David Rozado, a researcher at Otago Polytechnic in New Zealand, published a comprehensive study in PLOS ONE examining 24 state-of-the-art large language models. Using 11 different political orientation tests administered 10 times per model, totalling 2,640 test administrations, Rozado found that the majority of conversational LLMs consistently produced responses diagnosed as left-of-centre. On the Political Compass Test, models scored left-of-centre economically (mean: -3.69) and socially (mean: -4.19). Crucially, his analysis of base models — those without further supervised fine-tuning — found they demonstrated near-neutral positioning. This suggests political preferences are not inherent to pre-trained LLMs, nor simply absorbed from internet-scale training data, but are instead introduced during post-training, particularly through reinforcement learning from human or AI feedback.

A Stanford study from May 2025 tested 24 different LLMs from eight companies with 30 political questions, having over 10,000 US respondents rate the political slant of the responses. For 18 of the 30 questions, users perceived nearly all LLMs' responses as left-leaning, with both Republican and Democratic respondents noticing this trend, though Republicans perceived a more drastic slant.

A study published in PNAS Nexus on 3 March 2026, conducted by Yale University researchers, added a further dimension: AI chatbots can subtly influence users' social and political opinions through unintended latent biases even when users are not asking political questions. Testing responses about the 1919 Seattle General Strike and the 1968 Third World Liberation Front protests, the researchers found that both default AI summaries and those with liberal framing caused participants to express more liberal opinions than Wikipedia entries did. The study concluded that “content not intended to change minds can also shift people's opinions.” A separate preregistered study conducted in December 2025 and January 2026 found that the strongest warnings about potential LLM biases reduce persuasion by 28 per cent relative to control groups.

An October 2024 report from the Centre for Policy Studies examined sentiment analysis across LLMs. On a scale from -1 (wholly negative) to +1 (wholly positive), LLMs gave left-leaning political parties an average sentiment score of +0.71, compared to +0.15 for right-leaning parties. Hard-right positions received an average sentiment of -0.77, while hard-left positions received mostly neutral sentiment at +0.06.

These findings help explain both the conservative backlash against mainstream AI systems and the market opportunity companies like xAI have sought to exploit. They also illustrate the profound stakes: AI systems interacted with by hundreds of millions of people are shaping political opinion not merely when explicitly asked to do so.

Silicon Valley's Political Realignment

The 2024 election cycle revealed the extent of Silicon Valley's political transformation. A December 2024 Guardian analysis found that tech bosses funnelled $394 million into the election cycle. Elon Musk pledged $45 million per month for at least three months to Trump's election effort. Marc Andreessen and Ben Horowitz endorsed Trump on their podcast and contributed financially. Peter Thiel donated approximately $1.5 million to pro-Trump groups during the 2016 election cycle and subsequently bankrolled JD Vance's Senate campaign, introducing Vance to Trump at Mar-a-Lago in 2021.

By August 2025, major Democratic tech donors had largely retreated. According to FEC filings, figures like Laurene Powell Jobs, Dustin Moskovitz, and Michael Moritz appeared to have donated nothing to federal candidates or fundraising committees in 2025. Meanwhile, their Republican counterparts kept the money flowing.

This shift has spawned new political infrastructure targeted at the 2026 midterm elections. Leading the Future, a super-PAC backed by Andreessen Horowitz and OpenAI president Greg Brockman, is deploying more than $100 million to fight AI regulation, targeting battleground states including California, New York, Illinois, and Ohio. Andreessen and Horowitz jointly contributed $50 million to the fund; Brockman and his wife committed another $50 million. Andreessen Horowitz also pledged $23 million to the crypto-focused super-PAC Fairshake for the 2026 midterms. Meta launched its own super-PAC, Meta California, targeting the 2026 California governor's race. Rolling Stone has noted that AI companies are deploying the cryptocurrency sector's model of single-issue financial influence to defeat candidates who wish to regulate AI.

Downstream Effects: From Policy to Practice

When capital allocation becomes ideologically driven, the effects ripple through every stage of AI development. The events of early 2026 have brought those effects into sharp focus.

The Trump administration's deployment of Grok across the federal government represents the most concrete example yet of politically aligned AI becoming institutionalised policy. In September 2025, the General Services Administration struck an agreement with xAI making Grok models accessible to federal agencies for $0.42 per organisation for 18 months. On 12 January 2026, Defence Secretary Pete Hegseth announced during a speech at Musk's SpaceX headquarters that the Department of Defence would integrate Grok into its internal networks, including classified and unclassified systems, stating the systems would operate “without ideological constraints” and “will not be woke.” Three million military and civilian personnel gained access. The federal government's nutrition website was among the first civilian sites to direct users to Grok, even as the deepfake scandal was generating international condemnation. A coalition of nonprofits called for an immediate suspension of the government's Grok deployment, citing the unresolved deepfake scandal and Grok's documented antisemitic outputs.

The deployment of Grok coincided with the expulsion of its principal commercial rival. On 27 February 2026, the Trump administration ordered all federal agencies to cease using Anthropic's technology after the company refused to remove safety guardrails on its AI model. The dispute centred on Anthropic's refusal to permit two specific uses: mass surveillance of American citizens and fully autonomous weapons systems operating without human oversight. Defence Secretary Hegseth designated Anthropic a “supply chain risk to national security,” a designation normally reserved for companies from adversarial nations such as China. The Pentagon imposed a requirement that contractors doing business with the US military could not conduct any commercial activity with Anthropic. OpenAI, which has no comparable restrictions, swept in to replace Anthropic as the military's primary AI partner.

Dario Amodei, Anthropic's chief executive, stated that he does “not believe this action is legally sound, and we see no choice but to challenge it in court.” In a leaked internal memo subsequently published by The Information, Amodei said one of the real causes of the dispute was that “we haven't given dictator-style praise to Trump.” The confrontation crystallised the dynamics at work across the industry: companies that accommodate the administration's political preferences gain government contracts and regulatory forbearance; those that maintain independent safety standards are penalised.

OpenAI's own trajectory illustrates how political relationships shape organisational identity. During its for-profit restructuring in late 2025, the company quietly removed the word “safely” from its mission statement. Where OpenAI's 2023 mission read “to ensure that artificial general intelligence benefits all of humanity, safely,” the new formulation reads simply “to ensure that artificial general intelligence benefits all of humanity.” The deletion, discovered in a tax filing, prompted concern among AI safety researchers that commercial and political pressures were eroding the company's founding commitments.

Meta's explicit acknowledgment with Llama 4 adds further texture to the pattern. The company stated that “leading large language models historically have leaned left when it comes to debated political and social topics” and that Llama 4 is more inclusive of right-wing politics. Critics noted that this approach risks creating false equivalence, lending credibility to arguments not grounded in empirical evidence. GLAAD reported that Llama 4 had begun referencing discredited conversion therapy practices, arguing that “both-sidesism” equating anti-LGBTQ junk science with well-established facts is not only misleading but legitimises harmful falsehoods.

Implications for Democratic Discourse and Policy Institutions

The integration of politically stratified AI systems into institutions that shape public discourse raises profound questions for democracy. As of March 2025, ChatGPT had 500 million weekly users. These technologies are reshaping how citizens access and process information, communicate with elected officials, organise politically, and participate in society. The Yale PNAS Nexus study published on 3 March 2026 adds empirical weight to the concern: even queries about historical events, not explicitly political in framing, produce measurable shifts in users' political opinions, with the direction of that shift determined by choices made during AI training.

Research from the Carnegie Endowment for International Peace warns that AI technologies “present significant threats to democracies by enabling malicious actors, from political opponents to foreign adversaries, to manipulate public perceptions, disrupt electoral processes, and amplify misinformation.” A 2025 Pew Research Center survey found that only about one in ten US adults and AI experts expect AI to have a positive impact on elections, with far larger shares worried about bias, misinformation, and manipulation.

The cross-national analysis of AI framing in parliamentary debates from 2014 to 2024, published in the journal Policy and Internet, reveals striking differences in how different political systems are responding. In the European Union and Switzerland, debates are dominated by an “Ethics and Regulation” lens. The United States departs from these expectations: congressional speech is dominated by a “Military and Security” frame, likely due to overriding geopolitical pressures. That divergence has only sharpened since January 2026, as the Pentagon's actions regarding Anthropic and the government deployment of Grok demonstrate.

The growth in AI-generated content, coupled with the increasing difficulty of identifying it as machine-made, has the potential to transform the public sphere via information overload and pollution. For government officials, this undermines efforts to understand constituent sentiment, threatening the quality of democratic representation. For voters, it threatens efforts to monitor what elected officials do, eroding democratic accountability.

The Fragmented Future of AI Development

Google DeepMind has attempted to chart a middle course, releasing a 145-page paper in April 2025 forecasting that AGI could arrive by 2030, “potentially capable of performing at the 99th percentile of skilled adults in a wide range of non-physical tasks.” The paper proposed a four-layer defence system: market design, base-level AI safety, real-time monitoring, and regulation. Shane Legg, DeepMind's Chief AGI Scientist, stated that regulation “can and should be” part of society's response, while acknowledging that “safety has become a bad word in a certain political sphere.” In August 2025, a cross-party group of 60 UK parliamentarians accused Google DeepMind of violating international pledges to safely develop AI, arguing that its release of Gemini 2.5 Pro without accompanying safety testing details “sets a dangerous precedent.”

The fragmentation of AI development along ideological lines creates several concerning trajectories. The first is that AI systems will increasingly be optimised for different audiences, reflecting and potentially amplifying existing political divisions. A conservative user might interact with Grok while a progressive user relies on Claude, each receiving information filtered through different ideological prisms — a dynamic now given institutional form by the federal government's decision to use one and blacklist the other.

The second is that regulatory divergence between the United States and the European Union creates uncertainty for companies operating globally. Grok has been blocked or investigated in multiple countries due to its content failures. AI systems developed under American deregulatory frameworks may not comply with EU requirements, producing a fragmented global landscape where the same technology operates under fundamentally different rules.

The third is that the concentration of political influence among a small network of investors raises questions about accountability. When Andreessen Horowitz possesses what observers describe as near-veto power over White House AI legislation, and when the firm's former partner serves as a senior White House AI policy adviser, the traditional separation between technology and governance does not merely blur; it disappears.

Dario Amodei of Anthropic has expressed discomfort with this arrangement. “I think I'm deeply uncomfortable with these decisions being made by a few companies, by a few people,” he told Fortune in November 2025. “And this is one reason why I've always advocated for responsible and thoughtful regulation of the technology.” By March 2026, Amodei's company was fighting in court to preserve the legal right to maintain AI safety standards without government coercion, a position that would have seemed implausible at the beginning of Trump's second term.

The Contours of a Divided Future

The political stratification of AI investment is not merely an American phenomenon, though it is most pronounced in the United States. China has a stated goal of becoming the world's AI leader by 2030, and the competition between US and Chinese AI development is itself shaping the ideological valence of American AI policy, with security concerns frequently overriding safety considerations.

The Stargate Project exemplifies this dynamic. The joint venture intends to allocate $500 billion over four years. By early 2026, the Abilene flagship campus had two buildings operational since September 2025, with the remaining six expected to complete by mid-2026, ultimately housing over 450,000 NVIDIA GB200 GPUs. Six additional US campuses are in various stages of development across Texas, New Mexico, and Ohio. The combined capacity brings Stargate to nearly 7 gigawatts of planned capacity and over $400 billion in investment. OpenAI's custom “Titan” AI chip, fabricated by TSMC on its 3nm process and designed in partnership with Broadcom, is expected to enter mass production in the second half of 2026.

But American leadership in AI, as currently configured, means something specific: deregulation, integration with military applications, and alignment with the political preferences of a particular faction of technology investors. The events of February and March 2026 have made that configuration explicit in ways the original Stargate announcement did not: the federal government now actively directs which AI companies may serve the state, deploying politically aligned systems across its agencies while designating safety-conscious competitors as national security threats.

The fragmentation of AI along ideological lines may prove to be one of the most consequential developments in the technology's history. Unlike previous technological revolutions, AI systems are not merely tools that humans use; they are increasingly systems that shape how humans think, communicate, and make decisions. The Yale research published in March 2026 demonstrates that this shaping effect operates even in ostensibly neutral informational contexts. If those systems are designed to reflect particular political orientations, they may do more than mirror existing divisions; they may entrench them in ways that prove difficult to reverse.

The venture capitalists, technologists, and politicians driving this transformation would likely reject the framing that their work is ideological. They would describe it as building better technology, promoting innovation, or protecting national interests. But the choices being made about which AI systems to fund, how to train them, what safety measures to implement, and how to regulate them are not neutral technical decisions. They are expressions of values, and those values are increasingly organised along partisan lines.

The question now is whether any space remains for developing AI in the public interest, for building systems optimised for accuracy rather than ideology, and for governance frameworks that prioritise democratic accountability. Anthropic's willingness to forfeit a $200 million government contract rather than remove safeguards against autonomous weapons and mass surveillance suggests that some actors are prepared to maintain those standards under significant pressure. Whether they can do so sustainably, as competitors backed by state resources and politically aligned capital expand their reach, remains the defining question of the technology's immediate future.

References and Sources

Amodei, D. (2026, March). Where things stand with the Department of War. Anthropic. https://www.anthropic.com/news/where-stand-department-war

Bloomberg. (2026, February 10). Trump's AI Policy Shaped by VC Tech Giant Andreessen Horowitz. https://www.bloomberg.com/news/features/2026-02-10/trump-s-ai-policy-shaped-by-vc-tech-giant-andreessen-horowitz

Carnegie Endowment for International Peace. (2024, December). Can Democracy Survive the Disruptive Power of AI? https://carnegieendowment.org/research/2024/12/can-democracy-survive-the-disruptive-power-of-ai

Centre for Policy Studies. (2024, October). The Politics of AI by David Rozado. https://cps.org.uk/wp-content/uploads/2024/10/CPS_THE_POLITICS_OF_AI-1.pdf

CNBC. (2026, February 12). Anthropic closes $30 billion funding round at $380 billion valuation. https://www.cnbc.com/2026/02/12/anthropic-closes-30-billion-funding-round-at-380-billion-valuation.html

CNBC. (2026, March 5). Anthropic CEO says 'no choice' but to challenge Trump admin's supply chain risk designation in court. https://www.cnbc.com/2026/03/05/anthropic-ceo-says-no-choice-but-to-challenge-trump-admins-supply-chain-risk-designation-in-court.html

Federal News Network. (2026, January). Pentagon is embracing Musk's Grok AI chatbot as it draws global outcry. https://federalnewsnetwork.com/artificial-intelligence/2026/01/pentagon-is-embracing-musks-grok-ai-chatbot-as-it-draws-global-outcry/

Fortune. (2024, December 7). How Peter Thiel's network of right-wing techies is infiltrating Donald Trump's White House. https://fortune.com/2024/12/07/peter-thiel-network-trump-white-house-elon-musk-david-sacks/

Fortune. (2025, July 8). Users accuse Elon Musk's Grok of a rightward tilt after xAI changes its internal instructions. https://fortune.com/2025/07/08/elon-musk-grok-ai-conservative-bias-system-prompt/

Fortune. (2025, November 14). Anthropic says its latest model scores a 94% political 'even-handedness' rating. https://fortune.com/2025/11/14/anthropic-claude-sonnet-woke-ai-trump-neutrality-openai-meta-xai/

Fortune. (2025, November 17). Anthropic CEO warns that without guardrails, AI could be on dangerous path. https://fortune.com/2025/11/17/anthropic-ceo-dario-amodei-ai-safety-risks-regulation/

Fortune. (2026, February 23). OpenAI has changed its mission statement 6 times in 9 years, most recently about AI that 'safely benefits humanity'. https://fortune.com/2026/02/23/openai-mission-statement-changed-restructuring-forprofit-business/

Fortune. (2026, February 28). OpenAI sweeps in to snag Pentagon contract after Anthropic labeled 'supply chain risk'. https://fortune.com/2026/02/28/openai-pentagon-deal-anthropic-designated-supply-chain-risk-unprecedented-action-damage-its-growth/

Fox News. (2026, March 2). Musk, xAI tout newest Grok update as only 'non-woke' platform: 'Doesn't equivocate'. https://www.foxnews.com/politics/musk-xai-tout-newest-grok-update-as-only-non-woke-platform-citing-answers-to-key-questions

Google DeepMind. (2025, April). An Approach to Technical AGI Safety and Security. https://storage.googleapis.com/deepmind-media/DeepMind.com/Blog/evaluating-potential-cybersecurity-threats-of-advanced-ai/An_Approach_to_Technical_AGI_Safety_Apr_2025.pdf

GSA. (2025, September 25). GSA and xAI Partner on $0.42 per Agency Agreement to Accelerate Federal AI Adoption. https://www.gsa.gov/about-us/newsroom/news-releases/gsa-xai-partner-to-accelerate-federal-ai-adoption-09252025

NBC News. (2025). White House irked by Leading the Future, a new $100M pro-AI super PAC. https://www.nbcnews.com/news/amp/rcna239392

NPR. (2025, July 9). Elon Musk's AI chatbot, Grok, started calling itself 'MechaHitler'. https://www.npr.org/2025/07/09/nx-s1-5462609/grok-elon-musk-antisemitic-racist-content

NPR. (2025, December 12). Trump tech adviser David Sacks under fire over vast AI investments. https://www.npr.org/2025/12/12/nx-s1-5631823/david-sacks-ai-advisor-investment-conflicts

NPR. (2026, January 12). Governments ban the Grok chatbot due to nonconsensual bikini pics. https://www.npr.org/2026/01/12/nx-s1-5672579/grok-women-children-bikini-elon-musk

OpenAI. (2025, January 21). Announcing The Stargate Project. https://openai.com/index/announcing-the-stargate-project/

PLOS ONE. (2024). The political preferences of LLMs. David Rozado. https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0306621

Policy and Internet. (2025). When Politicians Talk AI: Issue-Frames in Parliamentary Debates Before and After ChatGPT. https://onlinelibrary.wiley.com/doi/full/10.1002/poi3.70010

Promptfoo. (2026). Evaluating political bias in LLMs. https://www.promptfoo.dev/blog/grok-4-political-bias/

Time. (2025, August). Exclusive: 60 U.K. Lawmakers Accuse Google of Breaking AI Safety Pledge. https://time.com/7313320/google-deepmind-gemini-ai-safety-pledge/

Washington Post. (2026, February 27). Pentagon declares Anthropic a threat to national security. https://www.washingtonpost.com/technology/2026/02/27/trump-anthropic-claude-drop/

White House. (2025, January 23). Removing Barriers to American Leadership in Artificial Intelligence. https://www.whitehouse.gov/presidential-actions/2025/01/removing-barriers-to-american-leadership-in-artificial-intelligence/

White House. (2025, December). Ensuring a National Policy Framework for Artificial Intelligence. https://www.whitehouse.gov/presidential-actions/2025/12/eliminating-state-law-obstruction-of-national-artificial-intelligence-policy/

Yale University. (2026, March 3). AI's hidden bias: Chatbots can influence opinions without trying. PNAS Nexus. https://news.yale.edu/2026/03/03/ais-hidden-bias-chatbots-can-influence-opinions-without-trying

Tim Green UK-based Systems Theorist & Independent Technology Writer

Tim explores the intersections of artificial intelligence, decentralised cognition, and posthuman ethics. His work, published at smarterarticles.co.uk, challenges dominant narratives of technological progress while proposing interdisciplinary frameworks for collective intelligence and digital stewardship.

His writing has been featured on Ground News and shared by independent researchers across both academic and technological communities.

ORCID: 0009-0002-0156-9795 Email: tim@smarterarticles.co.uk

"The troubled conscience..."

The troubled conscience, in view of God's judgment, has no remedy against desperation and eternal death, unless it takes hold of the forgiveness of sins by grace, freely offered in Christ Jesus, which if it can apprehend, it may then be at rest. Then it can boldly say: I seek not active or working righteousness, for if I had it, I could not trust it, neither dare I set it against the judgment of God. Then I abandon myself from all active righteousness, both of my own and of God's law, and embrace only that passive righteousness, which is the righteousness of grace, mercy, and forgiveness of sins. I rest only upon that righteousness, which is the righteousness of Christ and of the Holy Ghost.

— Martin Luther, “Declaration” in his Commentary on Galatians

It doesn't get any better than this, does it?

#Luther #quotes #theology

Tuesday

from  Roscoe's Story

Roscoe's Story

In Summary: * Happy that my Texas Rangers won their game against the Chicago Cubs this afternoon. Somewhat apprehensive about the storms that are supposed to hit us later tonight then continuing through tomorrow morning. Lord knows we need the rain, but we can do without the hail and high winds. I do take some consolation in the weather maps showing the heaviest weather hitting counties to the West and North of us, then sliding away from us to the North and East.

Prayers, etc.: * I have a daily prayer regimen I try to follow throughout the day from early morning, as soon as I roll out of bed, until head hits pillow at night. Details of that regimen are linked to my link tree, which is linked to my profile page here.

Starting Ash Wednesday, 2026, I've added this daily prayer as part of the Prayer Crusade Preceding the 2026 SSPX Episcopal Consecrations.

Health Metrics: * bw= 230.49 lbs. * bp= 150/88 (66)

Exercise: * morning stretches, balance exercises, kegel pelvic floor exercises, half squats, calf raises, wall push-ups

Diet: * 06:15 – 1 ham & cheese sandwich * 07:15 – 2 crispy oatmeal cookies * 09:50 – air-popped popcorn * 12:15 – biscuit & jam, hash browns, sausage, scrambled eggs, pancakes * 14:50 – home made meat & vegetable soup, fresh mango

Activities, Chores, etc.: * 05:00 – listen to local news talk radio * 05:45 – bank accounts activity monitored * 06:00 – read, write, pray, follow news reports from various sources, surf the socials, and nap * 13:20 – watching MLB Spring Training Game on MLB+, Toronto Blue Jays, vs. Atlanta Braves * 15:05 – now following two MLB Spring Training Games: 1.) Diamond Backs and Dodgers, live video and audio on MLB TV, and 2.) Cubs and Rangers, live scores and stats on MLB Gameday screen * 17:17 – and the Rangers beat the Cubs 8 to 3. Go Rangers! (Don't know what happened to the D'Backs and Dodgers. I lost their feed in early innings and never got it back.) * 18:00 – tuned into 1200 WOAI, the flagship station for the San Antonio Spurs, for pregame coverage then the call of tonight's game vs. the Boston Celtics.

Chess: * 14:00 – moved in all pending CC games

A direita portuguesa vem buscar os nossos corpos

from  Kuir - cultura e inspiração Cuir

Kuir - cultura e inspiração Cuir

A repatologização como projecto político: quando a direita se une contra a autodeterminação.

No dia 19 de março, a Assembleia da República vai decidir se Portugal continua a reconhecer que as pessoas trans existem sem pedir licença à medicina.

No próximo dia 19 de março, três partidos da direita portuguesa — Chega, PSD e CDS-PP — vão levar à Assembleia da República projectos de lei cujo objectivo é um só: desmantelar a Lei n.º 38/2018, que consagra o direito à autodeterminação da identidade de género. Não são três iniciativas independentes. É uma ofensiva coordenada contra a existência jurídica das pessoas trans em Portugal. E é preciso chamá-la pelo nome.

Bandeira Trans – Identidade e Direito. A luta pela autodeterminação de género em Portugal enfrenta uma nova ofensiva parlamentar. | Fotografia de Lena Balk (2020) – Uso gratuito sob a Licença da Unsplash

O Chega quer a revogação pura e simples da lei e o regresso a um modelo de diagnóstico clínico obrigatório. O PSD, pela mão de Hugo Soares — o mesmo que em 2015 propôs um referendo sobre a adopção por casais homossexuais e que, dias antes deste debate, não hesitou em invocar cinicamente os direitos das minorias e das mulheres para justificar o apoio cobarde de Portugal ao ataque dos EUA ao Irão —, apresenta um projecto que restaura o regime da Lei n.º 7/2011, devolvendo a profissionais de saúde o poder de decidir quem pode ou não alterar a menção do sexo no registo civil.

Entre as Lajes e a Lei 38: A Hipocrisia Homonacionalista de Hugo Soares

Um exemplo claro de retórica homonacionalista, onde Hugo Soares (PSD) invoca a proteção de mulheres e minorias no Irão para legitimar o apoio militar aos EUA , contrastando com a ofensiva contra a autodeterminação de género em Portugal agendada para 19 de março.

Extrato da Reunião Plenária de 4 de março de 2026. Intervenção: Hugo Soares (PSD) sobre o apoio logístico aos EUA e a condenação do regime iraniano em nome das mulheres e minorias. | Duração do corte: 23 segundos (De 00:27:24 — 00:27:47). | Fonte Original: Canal Parlamento – Reunião Plenária de 04/03/2026

A hipocrisia é cirúrgica: os direitos das minorias servem para justificar uma guerra, mas não para proteger pessoas trans em Portugal. O CDS-PP, por sua vez, quer proibir a prescrição de bloqueadores hormonais a menores de 18 anos em contexto de incongruência de género. Três projectos, um só gesto: retirar às pessoas trans o direito de se nomearem a si mesmas.

Sejamos precisos. A alteração da menção do sexo no registo civil é um acto administrativo. Não implica cirurgias. Não implica tratamentos hormonais. Não implica qualquer procedimento médico. É papel. É reconhecimento jurídico. E é exactamente isso que a direita quer condicionar. A confusão deliberada entre reconhecimento legal e intervenção clínica é a grande mentira desta ofensiva. Quem a repete sabe o que está a fazer.

Reintroduzir a exigência de diagnóstico clínico significa, na prática, obrigar pessoas trans a provar perante um painel de especialistas que a sua identidade é real. Significa devolver ao poder médico a capacidade de validar ou recusar a existência jurídica de alguém. Paul B. Preciado chamou a isto farmacopolítica: o Estado como regulador dos corpos dissidentes, distribuindo ou negando o acesso à identidade conforme critérios que não são científicos — são disciplinares. Judith Butler, há mais de três décadas, demonstrou que o género não é uma essência que a medicina possa certificar — é uma construção performativa que o poder reitera ou pune. Exigir um diagnóstico é precisamente reiterar a ficção de um género verdadeiro, acessível apenas por validação institucional.

A ciência fala contra a direita. E fala em português. A Sociedade Portuguesa de Sexologia Clínica emitiu um parecer técnico-científico sobre o projecto do Chega que não deixa margem para dúvidas: a iniciativa assenta em premissas que contradizem o consenso clínico internacional. Chamar ideologia à disforia de género, como faz o Chega, é negacionismo científico. A Organização Mundial de Saúde retirou a incongruência de género da categoria de perturbações mentais na CID-11. O parecer da SPSC vai mais longe e recorda que as dificuldades de saúde mental observadas em pessoas trans estão associadas ao estigma social e ao minority stress — não à identidade de género em si. Traduzindo: o problema não é ser trans. O problema é o que a sociedade faz a quem é trans. Legislar para aumentar o estigma é legislar para aumentar o sofrimento. Quem apresenta estes projectos de lei sabe-o — e fá-lo na mesma, porque o sofrimento das pessoas trans é rentável eleitoralmente.

Há um silêncio na proposta do PSD que merece ser nomeado. O projecto não faz qualquer referência às protecções relativas a pessoas intersexo menores de idade previstas na lei actual. A Lei n.º 38/2018 estabelece que, salvo risco comprovado para a saúde, intervenções cirúrgicas ou farmacológicas que modifiquem as características sexuais de menores intersexo não devem ser realizadas até que a pessoa possa manifestar a sua identidade de género. O PSD apaga esta disposição. O silêncio institucional sobre os corpos intersexo é sempre cúmplice da violência cirúrgica exercida sobre crianças cujos corpos não cabem na norma binária. Omitir não é esquecer. É autorizar.

Nada disto acontece no vazio. O relatório anual da ILGA-Europe de 2026 é categórico: a Europa entrou numa nova fase de regressão democrática. O que antes eram ataques pontuais contra pessoas LGBTI+ é agora política estruturada — limitação de direitos, criminalização, silenciamento. A Geórgia equipara relações homossexuais ao incesto. A Rússia classifica o movimento LGBTI+ como extremista. O Reino Unido redefine legalmente o conceito de mulher com base no sexo biológico. A administração Trump revoga protecções contra a discriminação de pessoas trans. É nesta companhia que a direita portuguesa quer colocar o país.

Mas há uma contra-corrente — e a direita portuguesa está do lado errado dela. Em fevereiro de 2026, o Parlamento Europeu aprovou uma resolução que recomenda o reconhecimento pleno das mulheres trans como mulheres, considerando a sua inclusão essencial para a eficácia das políticas de igualdade de género: 340 votos a favor, 141 contra, 68 abstenções. A extrema-direita e os conservadores ficaram em minoria. A resolução abrange ainda a protecção mais ampla de todas as pessoas LGBTIQ+, exigindo que a UE assuma a liderança na luta contra os movimentos antigénero. A Comissão Europeia lançou uma nova estratégia de igualdade LGBTIQ+ para 2026-2030 que nomeia explicitamente mulheres e homens trans. Enquanto a Europa institucional reconhece, a direita portuguesa quer revogar. Enquanto o Parlamento Europeu vota pela dignidade, o parlamento português agenda o retrocesso.

Do lado esquerdo do hemiciclo, o Bloco de Esquerda apresentou, pela mão de Fabian Figueiredo, um projecto que visa reforçar a aplicação da Lei n.º 38/2018 — orientações para escolas, formação para profissionais, mecanismos de apoio a estudantes trans. É necessário. Mas não basta. Dean Spade tem argumentado que os sistemas administrativos de classificação de género são, por natureza, mecanismos de controlo — e que a luta pela autodeterminação não se ganha apenas nos parlamentos. Ganha-se nas ruas, nas escolas, nos locais de trabalho, em cada espaço onde um corpo dissidente é forçado a justificar a sua existência.

O debate de 19 de março não é sobre procedimentos administrativos. É sobre quem tem o poder de definir quem somos. A direita portuguesa, colada numa ofensiva que vai de Budapeste a Washington, quer devolver esse poder ao Estado, à medicina e à norma. A nossa resposta é a mesma de sempre: os nossos corpos, a nossa palavra e a recusa absoluta de pedir licença para existir.

Projeto de Lei do Chega (CH): Objetivo: Revogação total da lei atual e regresso ao modelo de diagnóstico clínico obrigatório. Link/Referência: Projeto de Lei n.º 391/XVI/1.ª – Revogação da Lei n.º 38/2018.2.

Projeto de Lei do PSDObjetivo: Restaurar o regime da Lei n.º 7/2011, exigindo que profissionais de saúde validem a alteração do sexo no registo civil. O artigo nota ainda que este projeto omite as proteções para pessoas intersexo.Link/Referência: Projeto de lei n.º 486/XVII/1ª – Alteração ao regime jurídico da identidade de género.

Projeto de Lei do CDS-PPObjetivo: Proibir a prescrição de bloqueadores hormonais a menores de 18 anos em contexto de incongruência de género.Link/Referência: Projeto de Lei n.º 479/XVI/1.ª – Proteção de menores em cuidados de saúde de género.

#cuir #kuir #trans #autodeterminação #lei38 #direitostrans #portugal #assembleia #repatologização #SPSC #intersexo #LGBTI #feminismo #descolonial

the quiet mercy of unanswered prayers

from Douglas Vandergraph

There is a kind of prayer that only emerges after time has softened the sharp edges of memory. It is not the prayer we pray when we are desperate for something to happen, when our hands are clenched and our hearts are racing and our words come out hurried and breathless because we believe that if God would just give us this one thing, everything would finally fall into place. Those prayers are honest and sincere, but they are still shaped by the limited vision of a human heart that can only see the next few steps of the road ahead. The prayer I find myself praying now is different. It is slower. It is quieter. It carries the weight of years and the humility that comes from realizing how many times I was absolutely convinced I knew what I needed, only to discover later that what I wanted would have led me somewhere far less beautiful than where God ultimately guided me. So this prayer begins with gratitude, not for the things that came easily, but for the things that never arrived at all. Thank you, God, for protecting me from what I thought I wanted.

When we are young in faith, and sometimes even when we have walked with God for decades, we tend to interpret silence as absence and closed doors as rejection. We bring our requests before heaven with the quiet assumption that the best possible outcome is the one that matches our plans. We imagine the job that would make everything better, the relationship that would complete our lives, the opportunity that would finally place us on the path we believe we were meant to walk. And when those things do not come, the human heart often moves through a season of confusion. We wonder if we prayed incorrectly, if we were overlooked, if somehow the door remained closed because we were not worthy enough to step through it. Yet time has a way of revealing something far more profound than the immediate answer we were seeking. Time slowly teaches us that God's no is not rejection. It is protection.

I look back now at moments that once felt like disappointment and realize they were quiet acts of mercy. There were relationships I begged for that would have anchored my heart to people who were not meant to walk beside me for the long journey. At the time, those losses felt devastating because the human heart does not easily release something it has already imagined building a life around. But now, with distance and perspective, I see what God could see all along. I see the conflicts that would have grown, the misaligned values that would have slowly worn down the soul, the compromises that would have quietly pulled me away from the person I was meant to become. The door closed not because love was denied, but because a deeper kind of love was protecting me from a future that would have slowly eroded the peace God intended for my life.

There were also opportunities I chased with everything I had. I remember praying for certain paths to open with a level of certainty that felt almost unshakable. In those moments I was convinced that if God allowed that one opportunity to unfold, it would validate every effort I had poured into reaching it. Yet the opportunity never came, and for a while the absence of that breakthrough felt like failure. It is humbling to admit how long it sometimes takes to recognize the wisdom of divine restraint. Only later did I begin to notice the unseen redirections that followed those disappointments. Because the path that closed forced me to explore a different road, and that road slowly became the place where my voice, my purpose, and my calling began to take shape in ways I could never have predicted when I first asked for something else entirely.

One of the quiet truths of faith is that God's guidance often appears in the form of absence rather than presence. We tend to celebrate the doors that open, the breakthroughs that arrive, and the moments when our prayers seem to unfold exactly as we hoped. Those are beautiful moments and they deserve gratitude. But there is another category of divine work that rarely receives the same recognition. It is the silent intervention that prevents us from stepping into situations that would have drained our spirit, confused our direction, or slowly led us away from the life God designed for us. Those interventions rarely announce themselves with thunder. Instead they appear as delays, detours, unanswered emails, unexpected changes, and circumstances that shift just enough to redirect our steps.

In the middle of those experiences it is easy to feel frustrated. The human mind is wired to search for control and clarity, and when life refuses to follow the outline we carefully constructed, the uncertainty can feel unsettling. Yet faith invites us to consider the possibility that the unseen wisdom of God is operating far beyond the horizon of our immediate understanding. What appears to us as a delay may actually be a timing adjustment designed to align our lives with people and opportunities that have not yet arrived. What appears to us as a closed door may actually be the gentle hand of God steering us away from something that would have entangled us in unnecessary hardship.

I think about the prayers I prayed years ago, and I sometimes smile at the confidence I carried into those conversations with God. I truly believed I knew what would make my life complete. I imagined that if certain relationships had survived, if certain plans had succeeded, if certain dreams had unfolded exactly as I envisioned them, everything would have aligned perfectly. Yet standing where I am now, I can see how fragile those imagined futures really were. They were built on partial understanding, incomplete information, and emotional impulses that had not yet been refined by experience. God, in His patience, allowed me to feel the sincerity of those prayers without granting the outcomes that would have trapped me inside them.

There is a moment in every believer's life when gratitude begins to expand beyond answered prayers and into a deeper appreciation for the prayers that never materialized. That shift does not happen overnight. It grows slowly as we observe the way our lives unfold over time. We begin to notice the people who eventually entered our story, the opportunities that emerged from unexpected directions, and the ways our character matured through seasons that initially felt like loss. With enough distance, those once painful disappointments begin to reveal themselves as quiet turning points that protected our future.

The truth is that God sees connections we cannot see. He understands the ripple effects of decisions that have not yet happened and the unseen consequences of paths we are eager to walk. When we pray for something, we are often focusing on the immediate benefit we imagine it will bring. God, however, is considering the full arc of our life. He is thinking about who we are becoming, the influence we will carry, the people we will impact, and the spiritual depth that will shape the way we move through the world. When a request conflicts with that larger vision, the most loving answer God can give is no.

That kind of love can be difficult to recognize in the moment because it does not always feel comforting at first. It feels like confusion. It feels like waiting. It feels like watching something slip through your fingers that you were certain belonged in your future. But over time the wisdom of divine restraint begins to emerge. The very thing we once believed would complete our happiness reveals itself as something that would have limited our growth or redirected our lives away from the deeper purpose God was preparing.

Faith matures when we begin to trust not only the yes of God but also the no. We learn to believe that every response from heaven carries intention, even when that intention is not immediately clear. The story of Scripture reminds us repeatedly that God's plans unfold across timelines far longer than our own expectations. Abraham waited decades for promises to materialize. Joseph endured years of hardship before the purpose of his journey became visible. The disciples themselves often misunderstood the path Jesus was walking until the resurrection revealed what had been unfolding all along.

These stories remind us that God's perspective stretches across generations while ours often focuses on the next few months or years. The no we receive today may be protecting us from something we would only understand years later. The door that closes today may be guiding us toward a different environment where our gifts will flourish in ways we never anticipated. When we begin to see life through that lens, our prayers shift from demands into conversations filled with trust.

As the years move forward, something remarkable begins to happen inside the human heart that has walked with God through both answered and unanswered prayers. The heart begins to recognize patterns that were invisible before. What once looked like random disappointment begins to reveal itself as careful direction. Moments that seemed confusing begin to line up like quiet markers along a path that was being shaped long before we understood where it was leading. When I look back across my life now, I no longer see a collection of things that did not work out. I see a series of divine interventions that protected my future long before I had the wisdom to recognize what I was being protected from.

There were seasons when I prayed with absolute conviction that something needed to happen. I believed certain relationships were meant to continue. I believed certain doors needed to open. I believed certain answers needed to arrive quickly because the urgency in my heart felt overwhelming. In those moments, the silence of heaven felt almost confusing because my request felt sincere and heartfelt. Yet the passage of time revealed something that could never have been understood in the moment of asking. Those requests, if granted, would have altered the direction of my life in ways that would have quietly led me away from the deeper calling God had prepared.

It is humbling to admit how often we measure blessing by immediate satisfaction rather than long-term alignment with God's purpose. The human heart tends to interpret fulfillment through the lens of comfort, validation, and emotional relief. We imagine that the right relationship will finally quiet our loneliness, that the right opportunity will finally prove our worth, and that the right answer will finally remove the uncertainty that makes life feel unpredictable. But God measures fulfillment differently. He measures it through the lens of transformation, growth, character, and the quiet shaping of a soul that is learning how to trust Him beyond what can be immediately understood.

When I reflect on the doors that never opened, I realize that many of them would have placed me in environments that looked promising on the surface but carried hidden tensions beneath them. Some would have surrounded me with influences that slowly diluted the voice God was shaping inside my life. Others would have tied my future to circumstances that were never meant to sustain the kind of purpose God had written into my heart. At the time, I could not see those things. I could only see what I thought I wanted. Yet God's wisdom was already working beyond the horizon of my understanding.

There is something profoundly comforting about realizing that God's protection does not always arrive in dramatic form. Sometimes it comes through the quiet closing of a door that we tried desperately to open. Sometimes it appears in the form of a delay that forces us to grow into the person we will eventually need to be. Sometimes it arrives through the gradual dissolving of plans that once seemed perfect but were never meant to carry the full weight of our future. In each of those moments, what looks like disappointment is actually divine guidance gently redirecting our steps.

One of the most beautiful transformations in the life of faith occurs when gratitude expands to include the things that never happened. That kind of gratitude does not emerge from denial or forced optimism. It grows naturally from the realization that God's vision for our lives is broader and wiser than our immediate desires. When we begin to recognize how many unseen dangers we were quietly steered away from, our perspective begins to shift. The unanswered prayers that once felt painful become reminders that we were never navigating life alone.

There is a deep peace that settles into the soul when we understand that God's no is not the end of the story. It is simply the redirection of the path. What we thought we were losing was often the doorway to something far greater than we could have imagined at the time. That greater path does not always reveal itself immediately. Sometimes it unfolds slowly, step by step, as God shapes our character and prepares our hearts for the opportunities that will eventually appear.

Looking back now, I can see how many moments of protection were woven quietly into the story of my life. There were relationships that ended before they could turn into lifelong entanglements that would have drained the joy from my spirit. There were opportunities that slipped away just before they could pull my focus away from the calling that was slowly emerging inside me. There were delays that forced me to develop patience, humility, and resilience that I would later rely on when the path became more demanding.

At the time, none of those moments felt like protection. They felt like confusion, uncertainty, and sometimes even heartbreak. Yet the wisdom of time reveals what emotion could not see. Each of those moments was a quiet act of mercy. Each closed door was a hand gently guiding my life away from something that would have led me somewhere far less fulfilling than where God ultimately brought me.

Faith deepens when we begin to trust not only what God gives but also what God withholds. We start to realize that divine love operates with a level of foresight that we simply do not possess. While we are asking for what we think will make us happy today, God is shaping a life that will sustain meaning, purpose, and spiritual depth for decades to come. The things we thought we needed immediately were often distractions from the path that would eventually lead us toward something much more meaningful.

The prayer of gratitude that rises from this realization carries a different tone than the urgent prayers we once prayed. It is quieter and more reflective. It acknowledges that the journey has been guided even when we did not recognize the guidance at the time. It thanks God not only for the blessings that arrived but also for the dangers that were quietly avoided. It recognizes that protection often looks like loss in the moment but reveals itself as mercy when seen through the lens of time.

So this prayer becomes deeply personal. Thank you, God, for the relationships that did not last because they were never meant to shape the rest of my life. Thank you for the opportunities that slipped away because they would have pulled me away from the work you were preparing inside me. Thank you for the plans that collapsed because they were built on assumptions that could not carry the weight of the future you were designing. Thank you for the delays that forced me to slow down, reflect, and grow into the person who would one day recognize the wisdom of your timing.

There is a quiet confidence that grows in the heart when we begin to see life this way. It does not mean that disappointment disappears entirely. It simply means that disappointment no longer has the power to shake our trust in God's guidance. We begin to understand that every season carries purpose, even when that purpose is not immediately visible. The delays, the detours, the unexpected turns in the road all become part of a larger story that God is unfolding with patience and care.

When someone asks why something did not work out the way they hoped, I often think about how many times that same question lived inside my own heart. I remember the moments when I wished certain outcomes had been different. But standing where I am now, I realize that many of those outcomes would have quietly led me away from the life God intended for me to live. The things I thought I lost were actually the things that cleared the path for something better to appear later.

This understanding changes the way we pray. Instead of approaching God with the assumption that we already know the best possible outcome, we begin to pray with a deeper openness. We bring our hopes honestly before Him, but we also acknowledge that His vision extends far beyond our own. We trust that every response carries wisdom, even when that wisdom takes time to reveal itself.

The longer I walk through life with that perspective, the more I realize that the greatest blessings are often the ones that arrive after we release our insistence on controlling the outcome. When we loosen our grip on the specific form we believe our future must take, we create space for God to reveal possibilities we never considered. Those possibilities often lead to experiences, relationships, and opportunities that are far richer than the ones we once believed we needed.

So this message, this reflection, this prayer between a human heart and the God who has guided it through years of both clarity and confusion, ends with gratitude that is deeper than it once was. Not because life unfolded exactly the way I expected, but because it did not. The very things I once believed would define my happiness were quietly removed from my path so that something better could take their place.

Thank you, God, for protecting me from what I thought I wanted. Thank you for every closed door that kept me from stepping into a future that would have limited the person you were shaping me to become. Thank you for every delay that forced me to grow in patience, humility, and trust. Thank you for every unanswered prayer that quietly redirected my steps toward something more meaningful than I could have imagined at the time.

And if there is someone reading these words right now who is wondering why something in their life did not work out the way they hoped, I want them to understand something that took me years to fully grasp. God's silence is not abandonment. His no is not rejection. His delays are not indifference. They are often the quiet movements of a loving Father guiding your life away from something that would have limited your future and toward something that will one day make perfect sense.

The story you are living is still unfolding. The doors that closed behind you may have been protecting a path you have not yet discovered. And one day, when enough time has passed for the larger picture to come into focus, you may find yourself praying the same prayer I am praying now.

Your friend, Douglas Vandergraph

Thank you, God, for the things that never happened.

Watch Douglas Vandergraph’s inspiring faith-based videos on YouTube https://www.youtube.com/@douglasvandergraph

Support the ministry by buying Douglas a coffee https://www.buymeacoffee.com/douglasvandergraph

Financial support to help keep this Ministry active daily can be mailed to:

Vandergraph Po Box 271154 Fort Collins, Colorado 80527

Wearing a mask

from  Reflections

Reflections

from folgepaula

From tomorrow on I promise life will be today

06:30 alarm rings, time to wake up, I should take a shower, Livi it's all good baby, sleep a bit longer, towel, shower, why is it not heating up? fuck I turned off the flat heating and the water heating all together oh no check the control, test one. Nothing. Test two. Damn whatever, today is nordic cold shower day, let me check it after work. Damn its cold, its cold and my throat is hurting, you can do this Paula, you can do this, hold your breath, ok enough, where's the blowdryer, oh here it is, it's 7h00, let me dry just the scalp, ok. Good. The rest can dry by itself. Sun protector. Brush my teeth. Vitamin B12. Vitamin D. A glass of water. Cooome Livi! Let's go gassi, Livi! Slowly. Schau, Livi! Our friend crow! Hi, crow! How are you doing? Livi nonono, don't scare the crow, it's our friend, schatzi. Da, komm her! Nice, a pee, maybe another one? Great and potty? Super, Livi! Yaaay! Let's go back to have breakfast! Press D. Let's wash these paws? Hop Hop, bathtube. Bravo. Livi, Friss schön, Schatzi! Hmmm nhami. Super. Now let's wash the bowl, and change the clothes where's my beanie? Here it is. Livi, mom will go to work but she will be back soon ok? We will go out again. Go to bed. Bye, love you. Press E. The bike padlock. the key, thekeythekey here it is, nice. Helmet, Youtube > Leif Vollebekk in Kate Bush cover? wow, nice. What a beautiful day. Why are people bringing their 5 yo kids to the city bike lane? Are they crazy? Up to Maria Hilfe, nice, Kirchengasse, bring the bike up, office key, park the bike, laptop laptop, connect, display, two screens, nice. Email 1, email 2, email 3, teams chat, city light posters from Germany are missing the Spring campaign signature, no, it's not according to the guideline, could we change it please? ok, you focus on production with graphic designer, we'll contact the printer to check for reprint. Hi, good morning! Yes, fine, let's grab a coffee. Email 4, email 5, yes, to ingest it in the platform you need to save it as csv., no, this is an excel, fine, send it over, there you go, you can ingest it now, email 6, email 7, hey everyone, kind reminder could you please update the strategy function slides, our preview is today at 3PM, yes leadership is invited, yes, I'll present it, here's the last year campaign from 2025 review for comparison, slides 8, 11 and 13 please. thanks, great, merch check, ecommerce check, content check, paid media, owned media, PR, performance media check, email 8, email 9, email 10, brief for Spotify, radio spot, ok. Good, folks, I am going home, yeah tomorrow I am here. Okay, byeee. Take the bike, press E, cycle cycle cycle, press D. Hi Liiiivi, hi cutie, I missed you. Just one more call and we go out together ok? Done. Let's go, livi? GASSI? Who wants to go gassi? Yaaaaay! Hi, danke, yes, she's very sweet, no, it's not an afghani, yes, she's 4 years old now, Mädchen, ja, danke, Du bist auch schön, danke, rerere, Tschüss!! Let's go back, Livi, it's dinner time, yaaay, there you go, wash the paws again, super, now insect food nhami, ok, I will go back soon, Livi. Mom needs to buy something to eat. Billa or Spar Billa or Spar? Fuck it, Billa. Avocado. Rice cookies. Tofu. Barista oat milk. Banana. Hmmm, what else, ah whatever. Next time. Mit karte bitte, paaaast, danke, Tschüss! walk walk. press D. FUCK IT THIS LIFT IS STUCK AGAIN ARE YOU KIDDING ME. Ring the alarm. Hi. Yes. I'm stuck in the lift. Could you please send the assistance? Please be fast, please, thank you. I will wait. I mean, I can only wait. HAHAHAHA THAT'S FUCKING UNBELIEVABLE. Let's watch a video, 5 minutes, 10 minutes, 15 minutes, 20 minutes, HI, yes, I'm here, ok, yes, I can hear you. The control is on the first floor, ok, I'll wait, Hi, oh, thanks, this lift is always a struggle, thanks so much, saved my day. Hi Livi, I'm back, let me take a shower, will cuddle you soon. AH no, the heating. ok, Valliant manual, pump check all good, Gebläse check, hmm still on 0, maybe it's the hot water reservoir hmm Warmwasserspeicher, let's wait one minute, two minutes, 5 minutes. Nothing, ok I need a screwdriver. Found the screwdriver. Test one, test two, nothing. Ok, tomorrow I try again. Whatsapp, hi mom, all good, no don't worry, I'm fine. Heeey hi, yes it's been a while, hahaha, If I like Pedro Pascal? Of course I like him, who doesn't? What? Communist? Well, you had a dictatorship in Chile I kind of understand how it hits. Hm. Right, well, I tend to the left spectrum so it's hard to say something. Oh it's fine, you can write in Spanish if you prefer, I'll understand. Hm. Well, I'd still understand him being progressive? Oh the Apple ads, he did, well, yes, entiendo todo lo que dijiste, es contradictorio. Quizás él estaría dispuesto a apoyar temas progressistas, o ligeras intervenciones del Estado en servicios básicos. Hahaha, gotcha, yes, ok, well, I guess I need a shower, have a good evening! the 5th on Sunday then. Okay, cool. Oh wow, it's 21:00, I should be sleeping, I'll try to sleep. Where's my book? Livi, come here, lay down on your bed, Schatzi. Yes, super. I love you, you're the cutest. Tomorrow we take a longer walk ok? Sleep tight, love. I promise you from tomorrow on life will be today.

/mar26

CONTENT Warning: This post talks about suicide while actually using the word suicide. (More specifically, it discusses heavy feelings of suicidal ideation, my own suicide attempts, research on deaths by suicide with efforts to reduce stigma, and strong opinions you may not agree with).

Last year today, after languishingly slip p ing through another day at a job I loved, I coached my dispirited body towards the bus stop, an apparition. For months I had been sprinting, stagnant. Dial-up during my mom’s endless phone call. One quiet promise propelled me forward: You can kill yourself tonight. Fueled by relief, I got off the bus near the Secretary of State, a not-so-subtle SOS. It was my 35th birthday. My challenge: To buy 35 items from the dollar store I could end my life with. Creativity and determination have always been my strong suits. When pushed to full VOLUME, they drown out all attempts at logic, any willingness to see another perspective. For someone who is non-binary, it is baffling how often I only see two paths in front of me, live or die. Suicide was my only solution. Fortunately, the nature of existence is things will change.

The thing about suicidal ideation, in silence it swells, leaving little room for any other thoughts. It feeds off whispers around corn ers, off unspoken I love yous. It fills the spaces where words do not form: The only fertilizer worse than silence: words that validate, voices of others who do not challenge, but affirm.

Last week someone I knew and admired died by suicide. I wasn’t close with this person. I wont pretend to know the complexity of their circumstances or their choice to choose suicide. I know nothing of the difficulty or danger that comes with living in a Black body. All I know is a faint sliver of light, in the vast shadows of all I don’t. I don’t know if the outcome could have been changed. I don’t know that this person’s experience is even remotely related to mine. Still, I am alarmed and concerned at the public narrative around their suicide in the last week, and the tone of celebration, specifically from community leaders. I believe deeply: No human should have the power to play God. No amount of public influence or closeness of relationship should make someone eligible to decide whether another’s life is worth ending. No human can honestly discern whether someone is having a serious mental health crisis or a spiritual awakening.

With multiple residential stays on psych emergency floors, I can confidently estimate that around 60% of the people I met claimed they were having some type of spiritual rebirth, that their eyes had been open to what others could not see. Maybe they really were. As a human with a history of addiction and trauma, I’ve witnessed misinformation, ignorance, victim blaming, sexism, and transphobia from doctors, nurses, and even social workers. Still, at the end of the day, I would defer to a team of health professionals in deciding the health and wellbeing of someone else. I am by no means claiming that everyone who dies by suicide has mental illness. Diagnoses aside, we know that mental suffering is part of the human condition. We know as humans our brains evolve to help us survive, and if someone's brain is convincing them to die, likely something is wrong. Describing suicide deaths only with common platitudes such as, “they wanted to be free” or “they were tired”, carries a tone of glamorization and justification. There is no understanding or reason with suicide. For every individual there might be a complex web of reasons, all subjective. Rationalizing a person's death by suicide is only possible if objectively there is no other paths toward relief. That is impossible to know. Thus, it is impossible to justify. The experience of being suicidal, even for individuals like me who experience it chronically, is temporary. Endorsing someone’s reason to die by denying the possibility that their perception could change with time or treatment. We can validate their pain and experience without claiming that ending their life was the right or justified solution.

The truth is, when someone dies by suicide there are circumstances we cannot know. Here are some things we do know: </3 The World Health Organization names suicide as the 10th leading cause of death in the country, with it officially displacing COVID 19 in 2024. WHO also names stigma as the largest barrier. </3 Someone dies by suicide every 11 minutes (TDM, 2026). </3 People who know someone who died by suicide are three times more likely to die by suicide (NLM, 2022). </3 Media coverage that honestly talks about suicide, offering resources and coping strategies, dispelling myths, and sharing recovery stories reduces suicide rates. This is known as the Papagano effect. To put it simply, having truthful conversations about suicide decreases the likelihood that others will die by suicide.

I have debilitating depression that, at times, makes it impossible to see anything objectively, a fog so lightless it makes it impossible to see any exit sign that doesn’t read: DEATH. Last year, I couldn’t see how distorted my thinking was. I couldn’t access a faith that I would ever feel differently. I couldn’t remember a time I wasn't consumed with immobilizing heaviness. I was wrong.

When I told my friends I had no other options but to end my life. They didn’t respect my wishes. They didn’t choose to empower me or my autonomy. They called health professionals. Because they did, I am still here.

So when someone dies the way our friend did this week, I will say the truth plainly: They died by suicide. And I will keep saying it, because by saying it, by speaking about suicide honestly, we break the silence. We reduce the stigma. We save lives.

COMMON NARRATIVES ABOUT SUICIDE THAT ARE FALSE (Mayo Clinic, 2024).