Want to join in? Respond to our weekly writing prompts, open to everyone.

from folgepaula

From tomorrow on I promise life will be today

06:30 alarm rings, time to wake up, I should take a shower, Livi it's all good baby, sleep a bit longer, towel, shower, why is it not heating up? fuck I turned off the flat heating and the water heating all together oh no check the control, test one. Nothing. Test two. Damn whatever, today is nordic cold shower day, let me check it after work. Damn its cold, its cold and my throat is hurting, you can do this Paula, you can do this, hold your breath, ok enough, where's the blowdryer, oh here it is, it's 7h00, let me dry just the scalp, ok. Good. The rest can dry by itself. Sun protector. Brush my teeth. Vitamin B12. Vitamin D. A glass of water. Cooome Livi! Let's go gassi, Livi! Slowly. Schau, Livi! Our friend crow! Hi, crow! How are you doing? Livi nonono, don't scare the crow, it's our friend, schatzi. Da, komm her! Nice, a pee, maybe another one? Great and potty? Super, Livi! Yaaay! Let's go back to have breakfast! Press D. Let's wash these paws? Hop Hop, bathtube. Bravo. Livi, Friss schön, Schatzi! Hmmm nhami. Super. Now let's wash the bowl, and change the clothes where's my beanie? Here it is. Livi, mom will go to work but she will be back soon ok? We will go out again. Go to bed. Bye, love you. Press E. The bike padlock. the key, thekeythekey here it is, nice. Helmet, Youtube > Leif Vollebekk in Kate Bush cover? wow, nice. What a beautiful day. Why are people bringing their 5 yo kids to the city bike lane? Are they crazy? Up to Maria Hilfe, nice, Kirchengasse, bring the bike up, office key, park the bike, laptop laptop, connect, display, two screens, nice. Email 1, email 2, email 3, teams chat, city light posters from Germany are missing the Spring campaign signature, no, it's not according to the guideline, could we change it please? ok, you focus on production with graphic designer, we'll contact the printer to check for reprint. Hi, good morning! Yes, fine, let's grab a coffee. Email 4, email 5, yes, to ingest it in the platform you need to save it as csv., no, this is an excel, fine, send it over, there you go, you can ingest it now, email 6, email 7, hey everyone, kind reminder could you please update the strategy function slides, our preview is today at 3PM, yes leadership is invited, yes, I'll present it, here's the last year campaign from 2025 review for comparison, slides 8, 11 and 13 please. thanks, great, merch check, ecommerce check, content check, paid media, owned media, PR, performance media check, email 8, email 9, email 10, brief for Spotify, radio spot, ok. Good, folks, I am going home, yeah tomorrow I am here. Okay, byeee. Take the bike, press E, cycle cycle cycle, press D. Hi Liiiivi, hi cutie, I missed you. Just one more call and we go out together ok? Done. Let's go, livi? GASSI? Who wants to go gassi? Yaaaaay! Hi, danke, yes, she's very sweet, no, it's not an afghani, yes, she's 4 years old now, Mädchen, ja, danke, Du bist auch schön, danke, rerere, Tschüss!! Let's go back, Livi, it's dinner time, yaaay, there you go, wash the paws again, super, now insect food nhami, ok, I will go back soon, Livi. Mom needs to buy something to eat. Billa or Spar Billa or Spar? Fuck it, Billa. Avocado. Rice cookies. Tofu. Barista oat milk. Banana. Hmmm, what else, ah whatever. Next time. Mit karte bitte, paaaast, danke, Tschüss! walk walk. press D. FUCK IT THIS LIFT IS STUCK AGAIN ARE YOU KIDDING ME. Ring the alarm. Hi. Yes. I'm stuck in the lift. Could you please send the assistance? Please be fast, please, thank you. I will wait. I mean, I can only wait. HAHAHAHA THAT'S FUCKING UNBELIEVABLE. Let's watch a video, 5 minutes, 10 minutes, 15 minutes, 20 minutes, HI, yes, I'm here, ok, yes, I can hear you. The control is on the first floor, ok, I'll wait, Hi, oh, thanks, this lift is always a struggle, thanks so much, saved my day. Hi Livi, I'm back, let me take a shower, will cuddle you soon. AH no, the heating. ok, Valliant manual, pump check all good, Gebläse check, hmm still on 0, maybe it's the hot water reservoir hmm Warmwasserspeicher, let's wait one minute, two minutes, 5 minutes. Nothing, ok I need a screwdriver. Found the screwdriver. Test one, test two, nothing. Ok, tomorrow I try again. Whatsapp, hi mom, all good, no don't worry, I'm fine. Heeey hi, yes it's been a while, hahaha, If I like Pedro Pascal? Of course I like him, who doesn't? What? Communist? Well, you had a dictatorship in Chile I kind of understand how it hits. Hm. Right, well, I tend to the left spectrum so it's hard to say something. Oh it's fine, you can write in Spanish if you prefer, I'll understand. Hm. Well, I'd still understand him being progressive? Oh the Apple ads, he did, well, yes, entiendo todo lo que dijiste, es contradictorio. Quizás él estaría dispuesto a apoyar temas progressistas, o ligeras intervenciones del Estado en servicios básicos. Hahaha, gotcha, yes, ok, well, I guess I need a shower, have a good evening! the 5th on Sunday then. Okay, cool. Oh wow, it's 21:00, I should be sleeping, I'll try to sleep. Where's my book? Livi, come here, lay down on your bed, Schatzi. Yes, super. I love you, you're the cutest. Tomorrow we take a longer walk ok? Sleep tight, love. I promise you from tomorrow on life will be today.

/mar26

Surfing And Humility

Surfing saved my life.

That’s an over-dramatic way of putting it. Perhaps the more accurate thing to say is that surfing has played an integral role in the working out of my salvation, a grace from God that helps me better understand His grace overall. But saying “surfing saved my life” grabs one’s attention a little bit better.

I’d grown up a skateboarder, starting in the summer of 1996, which put me adjacent to surfing. Over the next four years or so, I’d be in surfing’s orbit in some form or another—either by being in stores that sold clothing and accessories related to both or because my youth pastor, who taught me a lot about skateboarding, was also a surfer and was trying to get me and my best friend to join him some Saturday.

My mom was not a beach person. So I seldom saw the ocean growing up. We lived in Orlando, which meant a trip to the beach would have been an event (at least an hour’s worth of driving each way). But I was very much into things like snorkeling and SCUBA. My first ever job was at a pet store that specialized in fish and I became borderline obsessed with the little critters to the point that I briefly considered ichthyology as a career. Which is all to say that I had a sort of hunger for the sea.

***

I’ve written about it before, but I was a kind of misfit kid. I didn’t really fit in with a lot of people, except my best friend and his little brother (who were practically family to me). I was too “Christian” for a lot of the cool kids at my school (even though it was a Baptist school), but also too alternative and grungy for the youth group set at the time. I fought with school administrators almost every day and openly rebelled against much of the fundamentalist elements in our church. I got really good at “code-switching” when around certain groups, only really feeling like myself when I was with friends or alone at home.

During my junior year of high school (second-to-last year before graduation, for those readers who might have a different school system) I got kinda tired of fighting with everyone. I watched Office Space for the first time and it opened my mind to a completely different way of thinking: not giving a shit. I decided to just do what I wanted to do. And I decided, after winter break, that I wanted to play baseball.

I worked hard. I carried a baseball with me everywhere like I was Pistol Pete and his basketball. I was throwing and catching after school, going to batting cages. I was hitting solid line drives off the 90 MPH pitching machine. But, I did not make the cut. I have my suspicions about this (my mom worked for the church of which my school was parochial and there had been long-simmering tensions between the two institutions; none of the church staff kids were picked that year). Regardless, this turned out to be a God-send because one day I was skating at the church and my best friend shows up and tells me that he and Eddy (our youth pastor) had gone surfing together and that it was awesome. He told me “my dad is going to take us to the beach tomorrow, you should come.”

That day would have been the date of my first baseball game had I made the team.

We drove to New Smyrna Beach, rented long boards, and waded out into the freezing cold water. I was in a wetsuit (I was taking SCUBA lessons as part of a Marine Biology class, so had acquired one as part of this, thankfully). I don’t remember much about the conditions. All I remember was taking the board to the white water and trying to catch whatever was breaking. New Smyrna, at high tide, has a long flat section of shallow water (which makes it ideal for kids playing at the beach and why it’s a popular family spot) and so I was pushing off the sand and into white water.

I’ll never forget standing up for the first time. The wave was maybe shin-high, and I was basically going straight toward the beach. But the speed and the simple fact that I was being moved by a small amount of water shifted something deep in my mind. I wound up getting hit by my board later that day, which also left an impression (both literally and figuratively):

there was something much bigger than me out there.

***

I was an angry kid. Apparently this is not uncommon for young men who grow up without fathers. My dad left my mom as soon as he found out she was pregnant with me and I never met the man (he died in July of last year). I don’t consider myself someone with “daddy issues” or whatever. But I do agree with something Donald Miller writes about in his book for guys who grow up without dads, entitled To Own A Dragon, where he notes that fathers (or father-figures) are key in helping young men learn to channel their aggressions and frustrations. We have a lot of testosterone, which is necessary for our development, and it begins to mess with us in our teenage to young adult years. Someone who’s been through it can help us navigate the path. I did not have that person.

I had a bunch of anger pent up and I took it out on authority figures, or on people that I felt were hypocritical. It often felt like the world was out to get me somehow. Plus, I was smart in a way that didn’t quite fit with my Baptist school environment (I excelled in creative pursuits; I was also quite good in history and Bible, which did afford me some accolades, but I hated doing homework and so my grades did not reflect, to the school’s eyes, my abilities). I was a self-centered little snot who thought he was smarter and better than everyone else around him. I did not realize it at the time, but I needed to get my ass kicked around a bit, on a kind of spiritual level.

***

One of my favorite surfing stories, one that has woven itself into the fabric of our shared mythology, is the story of Greg Noll’s last wave. The short version of the story is this: during an immense swell that hit the Hawaiian islands during the winter of 1969, Noll paddled out at Makaha (in defiance of law enforcement) and caught what people have said was the largest wave surfed at the time. Noll, known for his bombastic nature, allowed the size of the wave to get bigger in the retelling: first 50 feet, then 70, and so on. Regardless of the size, what’s true is that Greg Noll caught this wave, came in, loaded his board onto the roof of his car, and never surfed again. He continued to shape surfboards and be part of the industry. But he never paddled out again.

There are numerous interviews about this. The reason Noll gives for quitting surfing was that he had reached a point in life where, in his own words, he was begging God to send him a wave that he could not ride. He challenged God and God answered. He said that that wave humbled him and made him realize that he could not continue down this path anymore. Surfing was going to kill him because he did not know how or when to stop. Until that wave made that decision for him.

I love this story because it feels true to my situation. For Greg Noll, it took an eternally-growing wave to put him in his place. For me, it took an ankle-high roller.

I learned from that tiny wave that I was not the center of the universe. I would come to learn that I am a recipient of God’s grace, surfing the waves He sends.

***

That day of surfing set me on my path. I caught a wave that I’m still riding. If not for surfing, I would not be who and where I am today. Surfing would teach me about humility and God’s grace. It would also become a deciding factor in where I went to college, which would put me right in front of the Episcopal parish that would reignite my Christian faith after a few years of faltering. This would, of course, lead to my call to the ordained priesthood. It would also predispose me toward Hawai’i, the birthplace of surfing.

It was in March of 2000 that I first surfed. And it was in March of 2020 that I would begin my life in Hawai’i. There is a fairly straight line between those two points.

Had I remained an angry young man, I might’ve gone down a similar path as my dad. But God had other plans in mind.

So, yeah, surfing saved my life.

***

The Rev. Charles Browning II is the rector of Saint Mary’s Episcopal Church in Honolulu, Hawai’i. He is a husband, father, surfer, and frequent over-thinker. Follow him on Mastodon and Pixelfed.

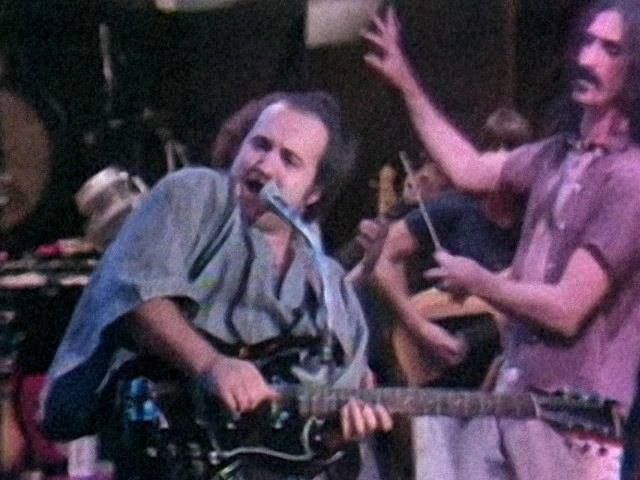

NOTE: The header photo is the only known close-up photo I have of myself surfing. It was taken by my friend Kurt probably in the summer of 2004 when I lived in Fort Pierce Florida. I’m surfing a kinda busted Yater Spoon that I bought on the cheap from Spunky’s Surfshop, a board that would also play an important role in my spiritual life, which I’ll write about some other time.

#Surfing #Spirituality #Christianity #Jesus #Theology

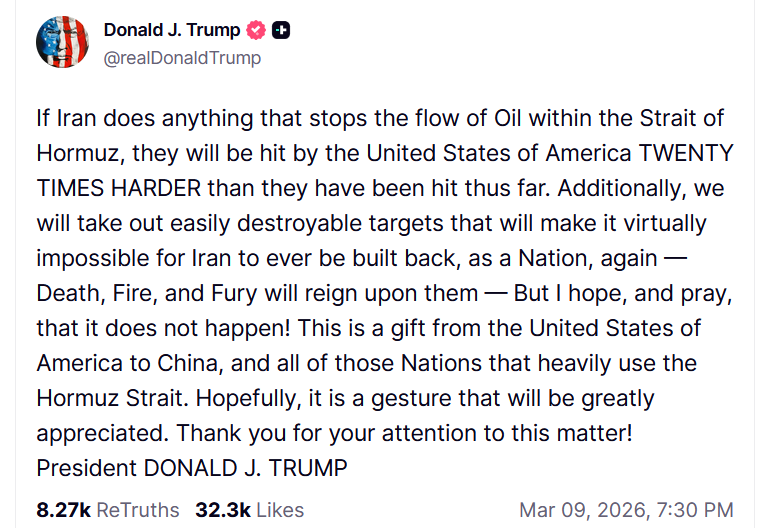

This is NOT Just War in Practice

“We will take out easily destroyable targets that will make it virtually impossible for Iran to ever be built back, as a Nation, again — Death, Fire, and Fury will reign [sic] upon them.”

This is NOT the Just War Tradition in practice. This is NOT how this works. It's simply not.

At best, this most certainly would violate the jus in bello tenets of distinction, proportionality, and military necessity. At worst, the United States would abdicate any claim to moral authority among the nation.

Clearly the regime in Iran is demonic and horrid, one of the worst in the world; however, from a Christian perspective all is NOT fair in love and war. It never has been. These are not the tactics of the United States of America. These are not the tactics of a nation behaving with honor. These are the tactics of treachery. These are the tactics of the ungodly.

You cannot rationalize this approach under any historic Christian understanding of the Just War Tradition. It is inexcusable. God, save us.

#history #politics #theology

Street Scene

from Tuesdays in Autumn

Until yesterday, it had been over twenty years since the means and opportunity last aligned such that I bought a painting. I'd been in Chepstow on Saturday morning, doing my usual rounds of the town's 'thrifting' locations, when, at the Red Cross charity shop I saw the walls lined with a dozen or more paintings and drawings. One in particular caught my eye — a street scene (Fig. 15) with a French look about it. The price was £100: high for a charity shop; not so high for a unique work of art. Unwilling to act on an immediate impulse, I decided to think it over.

Yesterday was a day off work. I'd been meaning to gather together a batch of records and CDs that had become surplus to requirements, and donate them somewhere. That somewhere, I realised, could be the Red Cross shop with the paintings. I dropped off the music and paid £103: for the painting plus a shirt I’d noticed while I was waiting for it to be taken down from the wall. The shop manager told me that the artworks had all come from the collection of a local ceramicist, who had been downsizing in advance of a move.

The painting is in oils or some other thickly-applied paint on a tatty old piece of board: there's some damage at its edges and at least one hole right through it. The frame is a somewhat distressed wooden one painted an unappealing shade of grey. The picture is signed and dated at the bottom right, though not altogether legibly. The artist's name was Peter S[omething] and the painting was made in (I think) '52. I've hung it at the top of the stairs, where a framed collage had previously been. I very much like how it looks there.

Elsewhere in Chepstow on Saturday I bought three '80s LPs for a tenner. These, I realised later, were linked by the letter 'L': the self-titled debut album by The Lounge Lizards; Will the Wolf Survive by Los Lobos; and Lyle Lovett & his Large Band. I was unfamiliar with all three but was happy to take a chance on them given their inexpensiveness. This was a trio that proved to be a decidedly mixed bag.

I'd seen or heard any number of mentions of the Lounge Lizards over the years without ever knowingly hearing a note of their music. On first acquaintance I really enjoyed the album: '50s jazz flavours served up with post-punk avant-garde attitude. An accomplished effort though it was, the Los Lobos record wasn't well-aligned with my current tastes and I didn't take a shine to it. As for the Lyle Lovett disc, it was a frustrating case inasmuch as I loved about half of it and disliked the rest: I may get a CD copy so I can more readily skip the tracks I don't care for.

I greatly admired Maria Stepanova's non-fiction opus In Memory of Memory when I read it a few years ago. Seeing a novel of hers (The Disappearing Act) has been newly published in English I thought I'd get a copy of it, and also try some of her poetry, in the shape of the 2021 collection War of the Beasts and the Animals. I read the latter (translated, like the other books, by Sasha Dugdale) on Wednesday and Thursday.

Inspired here & there by high modernism and dense with allusion, some of it felt opaque to the point of obscurity. Elsewhere were less forbidding poems based on ballads & songs, though some of those too came across like puzzles I couldn't necessarily solve. In short, although there were moments I could grasp and savour, I felt like its demands often exceeded my limited abilities as a reader.

Mike Elgan Nails It

from Mitchell Report

https://elgan.com/why-you-should-love-blogs-now-more-than-ever

Why you should love blogs now more than ever

, Mike Elgan (@MikeElgan@mastodon.social) on sharkey (source)

I saw Mike's post in my timeline, and it's referenced above. While I know some people hate AI with a passion, I agree that AI content has, for the most part, made the internet harder to enjoy. I agree with his post wholeheartedly, and maybe it will bring blogs – and hearing from people on blogs – back into the spotlight.

There was a time when most blogs looked quaint and personal, reflecting the owner's personality not only in their words but in the site's visuals. I also agree with Dave Winer's views on blogs, though not the idea of leaving everything completely unedited. If by “unedited” he means honest, uncensored feelings, I'm fine with that. But I do think having an AI or another human proofread your work is usually a good idea.

When I read some of my earlier posts from my youth – about 35 years ago when I was in my mid-twenties – I often think, what did I even mean there? It may make no sense now, and when I see something like that I cringe and immediately do some blog gardening and fix it. I don't want an AI to turn everything into perfect polish, but I do want my writing to make sense. Sometimes I ramble and chase rabbits the way I do in conversation, and that can lose readers' attention. I hate walking away from someone and thinking, what were we even talking about? That was all over the place.

So yes blogs look like they are coming back and that is a good thing in my opinion, and Google if you are listening, Blogger will be 30 years old in a few years. How about doing some updates to it, but keep it conservative and non-AI related and keep the spirit of it alive and just bring it forward into the modern age.

#blogging #opinion

John Belushi and Frank Zappa, SNL 1978

John Belushi and Frank Zappa, SNL 1978

Control of one’s output determines artistic longevity. Is career a long arc or a series of brilliant explosions?

from  Jall Barret

Jall Barret

Tidying up

Recently, I've been struggling to figure out what I'm working on in terms of writing. February was a kick ass month where I released video projects and did nearly 60K words.

I ended up going through my entire list of open projects and discovered I had about 15 fiction projects on my plate. I also found I had writing folders I didn't recognize by code name. That and some other things made me realize I might have too much going on.

When I was making appointments with clients regularly as part of my IT job, I came to a truth that has helped me ever since. If you give someone the open ended question “when would you like to meet,” you're probably not going to get an answer any time. You've got SLAs, and they've got a hypothetical infinity to choose from.

If you instead suggest two specific times, they may accept one of them or they may propose their own. The effective range of possibility is still the same but now it doesn't look nearly as intimidating.

I've used random number generators for myself since I was a child. Assign each possibility its own number and run the RNG. Even if it picks one I decide I definitely don't want to do, running the RNG helped make that possibility real enough to turn it down.

On the other hand, it also helps to clear out the clutter.

So I made a list of all my active projects and moved the others to a folder I use for projects that are on hold.

The number is still fifteen (or fourteen depending on how you count) but now I can see it a little better.

And maybe I can make myself an RNG project picker in Python that will read project names from my fancy new table.

At the moment, the big thing is to get enough of my mental desk clean so that I can think and do a bit of writing.

#PersonalEssay

Van Voorbijgaande Aard houdt zich staande aan de toog

from Lastige Gevallen in de Rede

Vijf keer iets zwaars op de maag, graag!

Och wat zou ik graag zitten met iets zwaars op de maag ook wacht ik nog op een gulle gever zodat ik iets heb voor op mijn lever mijn dieet is zelfs zo arm dat ik geen grip meer heb op mijn twaalfvingerige darm ik zou bij god niet weten wat er nog in me zit om op te vreten de laatste keer dat ik iets te bikken kon halen was vorige week toen ik er op bed over lag te malen kon ik de vrijheid van meningsuiting maar verliezen dan kreeg ik weer iets voor mijn kiezen ik kan er heel slecht tegen dat er niks op de schaal ligt voor wikken en wegen voor de lege keukenkastjes denk ik elk etmaal weer had ik bij die gehaalde gram maar een onsje meer het enigste waar ik nog een beetje van geniet is dat mijn ongebruikte keuken er iedere dag onberispelijk uitziet door deze vorm van buitensporige verschraling val ik van lieverlee steeds vaker in herhaling

Och wat zou ik graag zitten met iets zwaars op de maag ook wacht ik nog op een gulle gever zodat ik iets heb voor op mijn lever mijn dieet is zelfs zo arm dat ik geen grip meer heb op mijn twaalfvingerige darm ik zou bij god niet weten wat er nog in me zit om op te vreten de laatste keer dat ik iets te bikken kon halen was vorige week toen ik er op bed over lag te malen kon ik de vrijheid van meningsuiting maar verliezen dan kreeg ik weer iets voor mijn kiezen ik kan er heel slecht tegen dat er weer niks op de schaal ligt voor afwegen voor de lege keukenkastjes denk ik elk etmaal weer had ik bij de gehaalde gram maar een onsje meer het enigste waar ik nog een beetje van geniet is dat mijn ongebruikte keuken er iedere dag onberispelijk uitziet door deze vorm van buitensporige verschraling val ik van lieverlee steeds vaker in herhaling

Och wat zou ik graag zitten met iets zwaars op de maag ook wacht ik nog op een gulle gever zodat ik iets heb voor op mijn lever mijn dieet is zelfs zo arm dat ik geen grip meer heb op mijn twaalfvingerige darm ik zou bij god niet weten wat er nog in me zit om op te vreten de laatste keer dat ik iets te bikken kon halen was vorige week toen ik er op bed over lag te malen kon ik de vrijheid van meningsuiting maar verliezen dan kreeg ik weer iets voor mijn kiezen ik kan er heel slecht tegen dat er weer niks op de schaal ligt voor afwegen voor de lege keukenkastjes denk ik elk etmaal weer had ik bij de gehaalde gram maar een onsje meer het enigste waar ik nog een beetje van geniet is dat mijn ongebruikte keuken er iedere dag onberispelijk uitziet door deze vorm van buitensporige verschraling val ik van lieverlee steeds vaker in herhaling

Och wat zou ik graag zitten met iets zwaars op de maag ook wacht ik nog op een gulle gever zodat ik iets heb voor op mijn lever mijn dieet is zelfs zo arm dat ik geen grip meer heb op mijn twaalfvingerige darm ik zou bij god niet weten wat er nog in me zit om op te vreten de laatste keer dat ik iets te bikken kon halen was vorige week toen ik er op bed over lag te malen kon ik de vrijheid van meningsuiting maar verliezen dan kreeg ik weer iets voor mijn kiezen ik kan er heel slecht tegen dat er weer niks op de schaal ligt voor afwegen voor de lege keukenkastjes denk ik elk etmaal weer had ik bij de gehaalde gram maar een onsje meer het enigste waar ik nog een beetje van geniet is dat mijn ongebruikte keuken er iedere dag onberispelijk uitziet door deze vorm van buitensporige verschraling val ik van lieverlee steeds vaker in herhaling

Och wat zou ik graag zitten met iets zwaars op de maag ook wacht ik nog op een gulle gever zodat ik iets heb voor op mijn lever mijn dieet is zelfs zo arm dat ik geen grip meer heb op mijn twaalfvingerige darm ik zou bij god niet weten wat er nog in me zit om op te vreten de laatste keer dat ik iets te bikken kon halen was vorige week toen ik er op bed over lag te malen kon ik de vrijheid van meningsuiting maar verliezen dan kreeg ik weer iets voor mijn kiezen ik kan er heel slecht tegen dat er weer niks op de schaal ligt voor afwegen voor de lege keukenkastjes denk ik elk etmaal weer had ik bij de gehaalde gram maar een onsje meer het enigste waar ik nog een beetje van geniet is dat mijn ongebruikte keuken er iedere dag onberispelijk uitziet door deze vorm van buitensporige verschraling val ik van lieverlee steeds vaker in herhaling

Zeg Bar en Boosman heb ik dit stukje nou al eerder gepub- liceerd of niet?

from  Kroeber

Kroeber

#002308 – 23 de Setembro de 2025

Em Portugal fica-se muito impressionado com a fúria com que a equipa nacional de rugby canta o hino, como se fossem personagens do 300, em emocionados berros de quem se prepara para a guerra. Eu, neste futuro próximo em que o Irão continua a ser bombardeado e a ripostar espalhando a guerra em volta, fiquei impressionado com uma atitude oposta, bem mais corajosa: a equipa feminina de futebol do Irão, durante a Taça Asiática, protestou contra o regime iraniano com silêncio, recusando-se a cantar o hino. Fala-se agora de que repercussões podem sofrer ao regressar ao Irão, algumas jogadoras pediram asilo político.

What’s On My Kobo Reader?

It’s nice to know that some of my readers have Kobo devices. In addition to my Kindle Paperwhite Gen 7, I also have a Kobo Clara HD. I love my Clara because it’s so easy to upload EPUBs on it.

I’m currently reading The Last Coyote by Michael Connelly. After watching the entire seasons of Bosch, Bosch Legacy, and Ballard, I started reading the books from the beginning. I know Connelly also has the Lincoln Lawyer series and some standalone stories, maybe I’ll read them.

But I do want to read all the Bosch and Ballard ones. I’m quite surprised how different the books are compared to the TV shows. Still, I’m entertained and I can’t stop reading them.

So, what books are you reading right now? Let me know and I might check them out.

#books #Ballard #Bosch #Kindle #Kobo #reading

from  Roscoe's Quick Notes

Roscoe's Quick Notes

Spurs vs. Celtics.

My game of choice tonight comes from the NBA, it will feature the Boston Celtics vs. my San Antonio Spurs. With its scheduled start time of 7:00 PM Central Time, this is as late a game as I dare watch during the work week. (No, I don't work anymore, but the wife does. And I need to be up early to fix her coffee and help her leave on time.) So it'll be necessary to have my night prayers caught up by game's end so I can turn in right away.

And the adventure continues.

Joakim

from Holmliafolk

Jeg har to tatoveringer. Den ene er på leggen. Det hender jeg glemmer den litt, for jeg ser den sjelden, men jeg vet den er der. Den dukket opp på en heisatur til Rhodos for tre år siden. I LOVE BEERSKIS, står det. Jeg elsker ølski. Det hender folk tror det skal være whiskey, men nei, det er ølski, stå på ski og drikke øl.

Den andre fikk jeg på min første guttetur ever, til Ayia Napa. En kompis tok og tatoverte inn bursdagen sin på håndleddet, og da måtte jeg gjøre det og. 02.03.1993 på det venstre håndleddet, på innsiden, rett over pulsåra.

Det var for femten år siden. Jeg var 18 år. I dag fyller jeg 33.

The Catechetic Converter

The Catechetic Converter Ernest Ortiz Writes Now

Ernest Ortiz Writes Now