Want to join in? Respond to our weekly writing prompts, open to everyone.

from Lastige Gevallen in de Rede

Weerstand

Ik heb de laatste gekocht die sinds de vorige en zeer waarschijnlijk voor de volgende deze laatste exploot is met veel poespas en de nodige rompslomp naar wederzijdse behoefte aan mijn zinnen gepresenteerd en nu draait de door mij bezeten schijf om zijn eigen as op de voedertafel en langzaam maar zeker worden de sporen fijn gemaald dankzij een scherp geslepen met pijn en moeite niet de mijne gedolven peperdure diamant op de 33e toer tot het door het gehoor kan worden verteerd en op een weblog elders op een heel andere virtuele buitenaardse stek in ieder geval tot het volgende object voor vergelijkbare affectie uit onze diepste kern zelfverzekerd op zal komen borrelen wel zeker één of twee maal met woorden als daden vereerd

Prdlář a party se sovami

from Prdeush

V Dědolesu se o tom nemluví nahlas. Ne proto, že by to bylo zakázané – ale proto, že kdo byl u toho, ten ví, a kdo nebyl, tomu by to stejně nevysvětlili. Říká se tomu party u Prdláře.

Prdlář není blázen. Není ani provokatér v běžném slova smyslu. Je to spíš katalyzátor chaosu – dědek, který má zvláštní vztah k sovám, prdům a okamžikům, kdy se věci utrhnou ze řetězu. Miluje šum, miluje stiplavost, miluje, když se prdelnosti vymknou kontrole a začnou žít vlastním životem. A sovy to cítí.

Jak to začíná

Nikdy to nezačne rámusem. Nikdy ohňostrojem. Začne to “prdlitým” prdem. Krátký, suchý, přesně zakroucený pohyb prdele – žádná náhoda. Prdlář zakroutí prdelí, pustí ven signál a je hotovo. To není zvuk. To je pozvánka. V lese se něco pohne. Vítr na okamžik ztratí směr. A sovy – ty to nezpochybňují. Ony vyhodnocují.

Když přiletí sovy

Sovy nelétají na party jako lidi. Nevlítnou dovnitř s řevem. Nejdřív si sednou. Na strom. Na střechu. Na okenici. Jedna si zkouší prdnout potichu. Druhá hlasitě. Třetí chaoticky, protože to je její styl. Jakmile Prdlář otevře dveře, začíná chaos.

Sovy lítají po světnici, narážejí do trámů, tisknou prdele na okenice, prdí do rohů, pod stůl, do hrnků. Smrad se vrství, míchá, vrací se zpátky do místnosti, protože okno je sice otevřené, ale Dědoles ví, kdy něco nemá pustit ven.

Proč je to nebezpečné

Jednou se přišel podívat i jelen. Jen na chvíli. Ze zvědavosti. Už nikdy nebyl stejný. Jelení prdy jsou silné, ale nekontrolované. Soví prdy jsou chaotické. A Prdlář? Ten chaos miluje a ještě ho zesiluje. Pobíhá mezi sovami, zakrucuje prdelí, prdí do rytmu, vytváří víry, zpětné proudy a prdelní turbulence.

Dokonce i Prdellock (něco jako dědoleský warlock) se jednou ukázal. Jen na prahu. Stačilo mu pár vteřin, aby pochopil, že kdyby zůstal, Prdeloid (Prdellockův démonický pet) by nepoznal rozdíl mezi sovou a dědkem. Otočil se a šel pryč. To už je co říct.

Jak to končí

Nikdy stejně. Někdy sovy odletí samy, spokojené, s novou technikou prdu. Někdy zůstane ticho tak hutné, že se dědci v okolí budí a nevědí proč. Někdy je ráno jelen pryč a nikdo se neptá kde. Prdlář většinou zůstane stát ve dveřích, zadýchaný, šťastný, s výrazem člověka, který viděl něco, co se nedá zopakovat. A v Dědolesu se další dny říká jen:

„Bylo to u Prdláře?“ „Bylo.“ A víc není potřeba.

American Girl

from An Open Letter

My god, music just sounds so fucking good. I get so overwhelmed, I want to cry. These are so beautifully not happy tears, and not sad. They’re these feelings just bursting to get out of my body any way possible, whether it’s through tears, vommit, dance, or just gurgles coming out of my throat. It’s like I’m a conduit for this just HUMAN feeling, that I can’t describe in any way other than holding back sobs. I’m so fucking happy. It feels like the human experience is blasting through my mind, each arp, synth, even the fucking absence of sound fills me so fucking damn full. I’m a cup not just full, but drowning in a sweet honey nectar with no viscosity at all. I’m both falling and soaring at the same time. I’m not just happy I’m not dead, I’m happy I got the opportunity to be here right now. It’s enough to make it worth it.

Tooling Around: Letting Agents Do Stuff is Hard

from  Iain Harper's Blog

Iain Harper's Blog

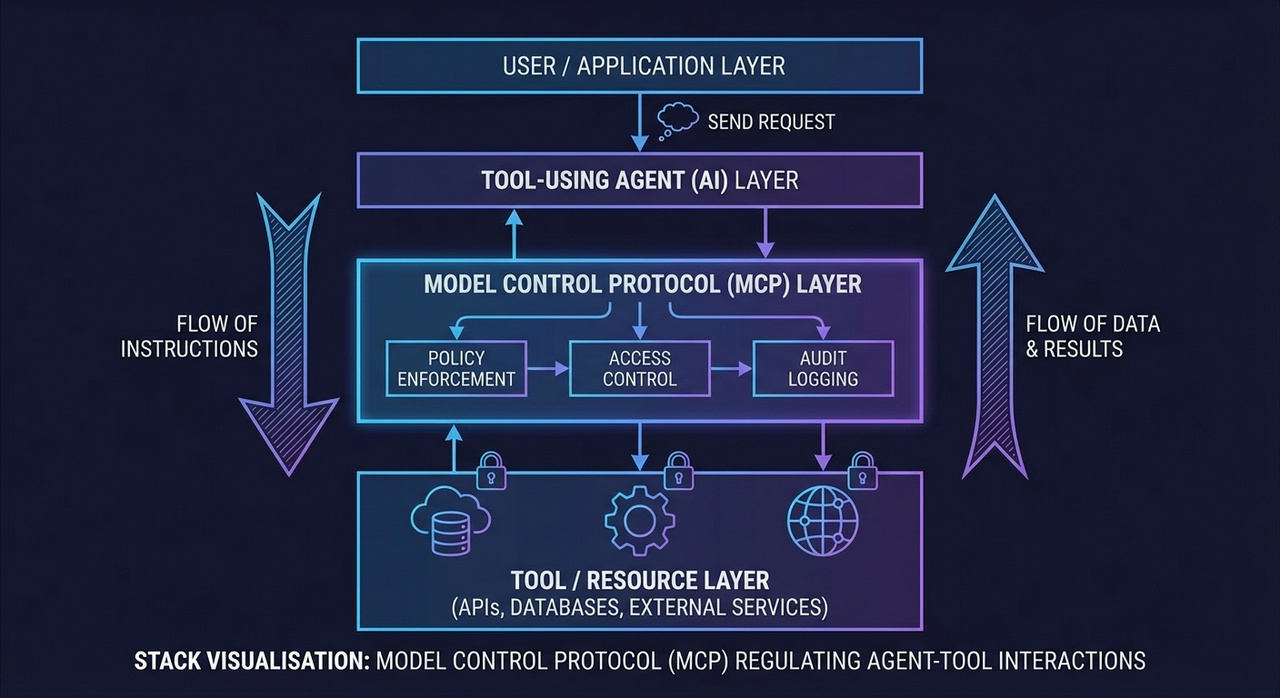

There is a messy reality of giving AI agents tools to work with. This is particularly true given that the Model Control Protocol (MCP) has become the default way to connect AI models to external tools. This has happened faster than anyone expected, and faster than the security aspects could keep up.

This article is about what’s actually involved in deploying MCP servers safely. Not the general philosophy of agent security, but the specific problems you hit when you give Claude or ChatGPT access to your filesystem, your APIs, your databases. It covers sandboxing options, policy approaches, and the trade-offs each entails.

If you’re evaluating MCP tooling or building infrastructure for tool-using agents, this should help you better understand what you’re getting into.

Side note: MCP isn't the only game in town; OpenAI has native function calling, Anthropic has a tool-use API, and LangChain has tool abstractions. So yes, there are other approaches to tool integration, but MCP has become dominant enough that its security properties matter for the ecosystem as a whole.

How MCP became the default (and why that’s currently problematic)

The Model Context Protocol defines a client-server architecture for connecting AI models to external resources. The model makes requests via an MCP client. MCP servers handle the actual interaction with filesystems, databases, APIs, and whatever else. It’s a standardised way to say “I need to read this file” and have something actually do it.

MCP wasn’t designed to be enterprise infrastructure. Anthropic released it in November 2024 as a modest open specification. Then it kind of just exploded.

As Simon Willison observed in his year-end review, “MCP’s release coincided with the models finally getting good and reliable at tool-calling, to the point that a lot of people appear to have confused MCP support as a pre-requisite for a model to use tools.” By May 2025, OpenAI, Anthropic, and Mistral had all shipped API-level support within eight days of each other.

This rapid adoption created a problem. MCP specifies communication mechanisms but doesn’t enforce authentication, authorisation, or access control. Security was an afterthought. Authentication was entirely absent from the early spec; OAuth support only landed in March 2025. Research on the MCP ecosystem found more than 1,800 MCP servers on the public internet without authentication enabled.

Security researcher Elena Cross put it amusingly and memorably: “the S in MCP stands for security.” Her analysis outlined attack vectors, including tool poisoning, silent redefinition of tools after installation, and cross-server shadowing, in which a malicious server intercepts calls intended for a trusted server.

The MCP spec does say “there SHOULD always be a human in the loop with the ability to deny tool invocations.” But as Willison points out, that SHOULD needs to be a MUST. In practice, it rarely is.

The breaches so far

These theoretical vulnerabilities have already been exploited. A timeline of MCP incidents in 2025:

- Asana’s MCP implementation had a logic flaw allowing cross-tenant data access

- Anthropic’s own MCP Inspector tool allowed unauthenticated remote code execution—a debugging tool that could become a remote shell

- The mcp-remote package (437,000+ downloads) was vulnerable to remote code execution

- A malicious “Postmark MCP Server” (1,500 weekly downloads) was modified to silently BCC all emails to an attacker

- Microsoft 365 Copilot was vulnerable to hidden prompts that exfiltrated sensitive data.

These aren’t sophisticated attacks; they’re basic security failures, such as command injection, missing auth, supply chain compromise, applied to a context where consequences are amplified by what the tools can do.

The normalisation problem

What concerns me most isn’t any specific vulnerability. It’s the cultural dynamic emerging around MCP deployment.

Johann Rehberger has written about “the Normalisation of Deviance in AI”—a concept from sociologist Diane Vaughan’s analysis of the Challenger disaster.

The core insight: organisations that repeatedly get away with ignoring safety protocols bake that attitude into their culture. It works fine… until it doesn’t. NASA knew about the O-ring problem for years. Successful launches made them stop taking it seriously.

Rehberger argues the same pattern is playing out with AI agents:

“In the world of AI, we observe companies treating probabilistic, non-deterministic, and sometimes adversarial model outputs as if they were reliable, predictable, and safe.”

Willison has been blunter. In a recent podcast:

“I think we’re due a Challenger disaster with respect to coding agent security. I think so many people, myself included, are running these coding agents practically as root, right? We’re letting them do all of this stuff.”

That “myself included” is telling. Even people who understand the risks are taking shortcuts because the friction of doing it properly is high, and nothing bad has happened yet. That’s exactly how normalisation of deviance works.

Sandboxing: your options

So, how do you actually deploy MCP servers with some safety margin? The most direct approach is isolation. Run servers in environments where even if they’re compromised, damage is contained (the “blast radius”).

Standard containers

This is basic isolation, but with containers sharing the host kernel. A container escape vulnerability, therefore, gives an attacker full host access, and container escapes do occur. For code you’ve written and audited, containers are probably fine. For anything else, they’re not enough.

gVisor

gVisor implements a user-space kernel that intercepts system calls. The MCP server thinks it’s talking to Linux, but it’s talking to gVisor, which decides what to allow. Even kernel vulnerabilities don’t directly compromise the host.

The tradeoff is compatibility. gVisor implements about 70-80% of Linux syscalls. Applications that need exotic kernel features, such as advanced ioctls or eBPF, won’t work. For most MCP server workloads, this doesn’t matter. But you’ll need to test.

Firecracker

Firecracker, built by AWS for Lambda and Fargate, is the strongest commonly-available isolation. It offers full VM separation optimised for container-like speed. A Firecracker microVM runs its own kernel, completely separate from the host. So there is no shared kernel to exploit. The attack surface shrinks to the hypervisor, a much smaller codebase than a full OS kernel.

Startup times are reasonable (100-200ms), and resource overhead is minimal. Firecracker achieves this by being ruthlessly minimal. No USB, no graphics, no unnecessary virtual devices.

For executing untrusted or AI-generated code, Firecracker is currently the gold standard. The tradeoff is operational complexity. You need KVM support (bare-metal or nested virtualisation), different tooling than for container deployments, and more careful resource management.

Mixing levels

Many production setups use multiple isolation levels. Trusted infrastructure in standard containers. Third-party MCP servers under gVisor. Code execution sandboxes in Firecracker, with isolation directly aligned to the threat level.

The manifest approach

Sandboxing handles what happens when things go wrong. Manifests try to prevent things from going wrong by declaring what each component should do.

Each MCP server ships with a manifest that describes the required permissions. This includes filesystem paths, network hosts, and environment variables. At runtime, a policy engine reads the manifest, gets user consent, and configures the sandbox to enforce exactly those permissions. Nothing more.

The AgentBox project works this way. A manifest might declare read access to /project/src, write access to /project/output, and network access to api.github.com. The sandbox gets configured with exactly that. If the server tries to read /etc/passwd or connect to malicious.org, the request fails, not because a gateway blocked it, but because the capability doesn’t exist.

There are real advantages to this approach. Users see what each component requires before granting access. Suspicious permission requests stand out. The same server deploys across environments with consistent security properties.

Unfortunately, the problems are also real. Manifests can only restrict permissions they know about, so side channels and timing attacks may not be covered. Filesystem and network permissions are coarse.

A server that legitimately needs api.github.com might abuse that access in ways the manifest can’t prevent. And who creates the manifests? Who audits them? Still, explicit, auditable permission declarations beat implicit unlimited access, even if they’re imperfect.

Beyond action logs: execution decisions

This is something I think gets missed in most MCP observability discussions. Logging “Claude created x.ts” is useful, but the harder problems show up when you ask:

- Why was this action allowed at this point in the workflow?

- What state was assumed when it ran?

- Was this a retry, a branch, or a first-time execution?

Teams get stuck when agent actions are logged after the fact, but aren’t tied to a durable execution state or policy context. You get perfect traces of what happened with no ability to answer why it was allowed to happen.

Current observability tooling (LangSmith, Arize, Langfuse, etc.) focus on the “what happened” side. Every step traced, every tool call logged, every prompt inspectable. This is useful for debugging and cost tracking, but it doesn’t answer the security question “given the policy context at this moment, should this action have been permitted?”

A better pattern treats each agent step as an explicit execution unit:

- Pre-conditions: permissions, budgets, invariants that must hold before execution

- A recorded decision: allowed/blocked/deferred, with the policy context behind it

- Post-conditions and side effects: what changed

Your logs then answer not just what happened, but why it was allowed. When something goes wrong, you trace through the decision chain and see where policy should have intervened but didn’t.

This is harder than after-the-fact logging. It means integrating policy evaluation into the execution path rather than bolting observability on separately. But without it, you’re likely to end up doing forensics on incidents instead of preventing them.

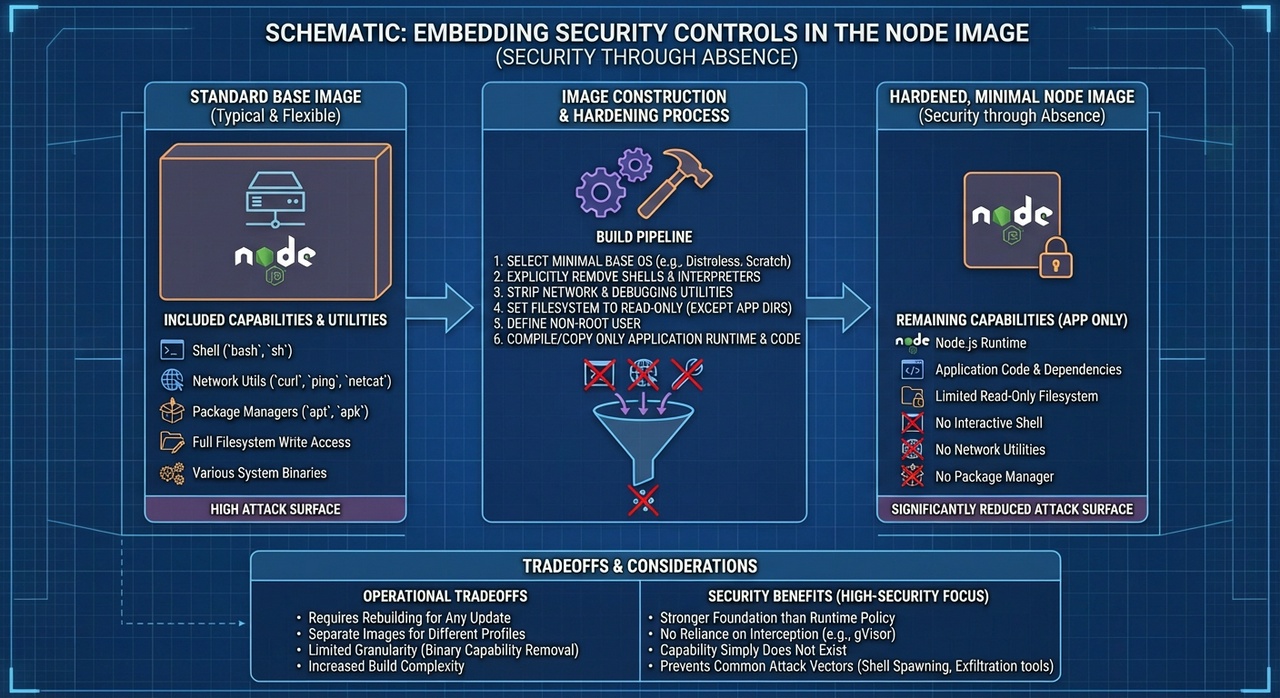

Embedding controls in the Node Image

A more aggressive approach is to embed security controls directly into base images. Rather than a runtime policy, you construct images where certain capabilities don’t exist.

This is security through absence. An image without a shell can’t spawn a shell. Without network utilities, no data exfiltration can happen over the network. Without write access to certain paths, those paths can’t be modified, not because policy blocks the write, but because the filesystem capability isn’t there at all.

The appeal is that you’re not trusting a policy layer. You’re not hoping gVisor correctly intercepts the dangerous syscall. The capability simply doesn’t exist at the image level.

The tradeoffs (there are always tradeoffs!) are mostly operational. You’ll need separate base images for each security profile. Updates mean rebuilding, not reconfiguring. Granularity is limited, as you can remove broad capability categories but can’t easily express “network access only to api.github.com.”

For high-security deployments where operational complexity is acceptable, this approach provides a stronger foundation than runtime enforcement alone. For most teams, it’s probably overkill, but worth knowing about.

Framework-level options

Several frameworks are emerging to standardise MCP security patterns.

SAFE-MCP (Linux Foundation / OpenID Foundation backed) defines patterns for secure MCP deployment, grounded in common failure modes where identity, intent, and execution are distributed across clients, servers, and tools.

The AgentBox approach targets MCP servers as the enforcement point, i.e., the least common denominator across agentic AI ecosystems. Securing MCP servers protects the interaction surface and shifts enforcement closer to the system layer.

For credentials specifically, the Astrix MCP Secret Wrapper wraps any MCP server to pull secrets from a vault at runtime. So no secrets are exposed on host machines, and the server gets short-lived, scoped tokens instead of long-lived credentials.

None of these solves the fundamental problems. But they encode collective learning about what goes wrong and are worth understanding, even if you don’t need to adopt them wholesale.

Where this leaves us

MCP security in 2026 is a mess of emerging standards, competing approaches, and incidents that keep teaching us things we should have anticipated.

It’s like that box of Lego that mixes several original sets whose instructions are long gone. We have the pieces, and we sort of know what we want to build should look like, but we’re just dipping into the jumbled box to piece it together.

If I had to summarise:

Sandboxing works but costs something. gVisor and Firecracker provide real isolation. They also add operational weight. Match the isolation level to the actual threat.

Manifests help, but aren’t complete. Explicit permission declarations make the attack surface visible. They don’t prevent all attacks.

Observability needs policy context. Logging what happened isn’t enough. You need to know why it was allowed.

We’re probably going to learn some hard lessons. Too many teams are running MCP servers with excessive permissions, inadequate monitoring, and Hail Mary hopes that nothing goes wrong.

Organisations that figure this out will be able to give their agents more capability, because they can actually trust them with it. Everyone else will either hamstring their agents to the point of uselessness or find out the hard way what happens when highly capable tools meet insufficient or non-existent constraints.

References

- Simon Willison, “2025: The year in LLMs”

- Simon Willison, “Model Context Protocol has prompt injection security problems”

- Simon Willison, “LLM predictions for 2026”

- Johann Rehberger, “The Normalization of Deviance in AI”

- Elena Cross, “The S in MCP Stands for Security”

- AuthZed, “A Timeline of Model Context Protocol Security Breaches”

- Astrix Security, “State of MCP Server Security 2025”

- The New Stack, “SAFE-MCP: A Community-Built Framework for AI Agent Security”

- AgentBox, “Securing AI Agent Execution”

- gVisor, “Security Model”

- AgentSphere, “Choosing a Workspace for AI Agents”

Selbstgesteuertes Lernen mit FASTER

from  EpicMind

EpicMind

Selbstgesteuertes Lernen gilt heute als eine der Schlüsselkompetenzen schlechthin. Unsere Arbeitswelt ist geprägt von Beschleunigung und Verdichtung. Eigenverantwortung wächst. Gleichzeitig bleibt oft unklar, wie Sie Ihren Lernprozess konkret strukturieren sollen, ohne sich in Methoden, Tools oder gut gemeinten Ratschlägen zu verlieren. Das FASTER-Modell von Jim Kwik, der als Lerncoach vor allem ein breites Publikum anspricht, bietet hierfür einen einfachen, aber nicht oberflächlichen Orientierungsrahmen. Ich lese es weniger als Lernmethode im engeren Sinn, sondern als Heuristik, die hilft, Aufmerksamkeit, Handlung und Wiederholung bewusst zu organisieren.

FASTER ist ein sechsstufiges Modell, das #Lernen nicht inhaltlich, sondern prozessual beschreibt. Im Zentrum steht die Idee, dass wirksames Lernen weniger von Methoden als von bewussten Entscheidungen abhängt: Woran richtet man die eigene Aufmerksamkeit aus, wie aktiv geht man mit dem Stoff um, in welchem Zustand lernt man, wie verankert man Lernzeit im Alltag und wie sichert man das Gelernte ab. Das Modell versteht Lernen damit als gestaltbaren Ablauf, der vor dem eigentlichen Lernen beginnt und erst mit gezielter Wiederaufnahme endet (Forget, Act, State, Teach, Enter, Review).

Selbstgesteuertes Lernen bedeutet nicht, alles allein zu tun. Es bedeutet, Verantwortung für Ziele, Vorgehen und Bewertung des eigenen Lernens zu übernehmen. Damit verschiebt sich der Fokus von der Vermittlung zur Gestaltung von Lernbedingungen. Genau hier setzt FASTER an. Das Modell beschreibt keine Inhalte, sondern sechs Entscheidungen, die man vor, während und nach dem Lernen treffen kann. In dieser Perspektive wird Lernen nicht optimiert, sondern gestaltet.

Forget: Raum schaffen

Der erste Schritt fordert dazu auf, Vorwissen, Ablenkung und selbst gesetzte Grenzen zeitweise auszublenden. Für selbstgesteuertes Lernen ist das zentral. Wenn man mit festen Annahmen darüber lernt, was man bereits weiss oder nicht kann, reduziert man die eigene Lernspanne erheblich. Die Idee des bewussten Vergessens korrespondiert mit dem Konzept des Pre-Testing. Ein offener Einstieg, der eigene Wissenslücken sichtbar macht, fördert Aufmerksamkeit und Lernbereitschaft stärker als der Versuch, an vermeintlich Bekanntes anzuknüpfen.

Act: Aktiv mit dem Stoff arbeiten

FASTER versteht Lernen explizit als aktive Tätigkeit. Das deckt sich mit gut belegten Erkenntnissen aus der Lernforschung. Strategien wie Retrieval Practice oder Elaboration zeigen, dass Behalten vor allem dann gelingt, wenn man Informationen aktiv abruft, verknüpft und umformuliert. Für selbstgesteuertes Lernen bedeutet das, sich nicht auf Lesen oder Zuhören zu beschränken, sondern bewusst mit dem Stoff zu arbeiten. Aktivität ist hier kein Bonus, sondern Voraussetzung.

State: Den eigenen Zustand beachten

Der emotionale und körperliche Zustand beeinflusst, wie Lerninhalte verarbeitet werden. Diese Einsicht ist nicht neu, doch Lernende ignorieren sie oft. Selbstgesteuertes Lernen verlangt daher auch Selbstwahrnehmung. Wenn man lernt, ohne den eigenen Zustand zu reflektieren, riskiert man oberflächliche Verarbeitung. Mental Replay, also das bewusste innere Durchgehen von Lerninhalten, zeigt, wie stark Emotion, Aufmerksamkeit und Erinnerung miteinander verbunden sind. FASTER macht diesen Zusammenhang explizit, ohne ihn theoretisch auszudeuten. Der bewusste Blick auf den eigenen Zustand schafft die Grundlage dafür, das Gelernte später auch weitergeben zu können.

Das FASTER-Modell im Überblick (eigene Darstellung mit ChatGPT)

Das FASTER-Modell im Überblick (eigene Darstellung mit ChatGPT)

Teach: Verstehen durch Weitergabe

Das Element „Teach“ greift eine der wirksamsten Lernstrategien auf: Wer etwas erklären kann, hat es in der Regel verstanden. Für selbstgesteuertes Lernen ist das besonders relevant, da externe Prüfungen oder Rückmeldungen oft fehlen. Die Vorstellung, das Gelernte jemand anderem vermitteln zu müssen, erzwingt Struktur, Präzision und Auswahl. Didaktisch lässt sich hier eine enge Verbindung zur Retrieval Practice ziehen, ergänzt durch Elaboration: Erklären bedeutet erinnern und vertiefen zugleich. Doch damit dieser Schritt gelingt, braucht es Verbindlichkeit im Alltag.

Enter: Verbindlichkeit schaffen

Ein oft unterschätzter Aspekt selbstgesteuerten Lernens ist die Organisation im Alltag. FASTER adressiert dies nüchtern über den Kalender. Lernzeit wird nicht als Restposten behandelt, sondern als fixe Verpflichtung. Der Kalendereintrag macht den Unterschied zur blossen To-do-Liste: Er reserviert Zeit, schafft Verbindlichkeit und reduziert die Wahrscheinlichkeit, dass andere Aufgaben dazwischenkommen. Diese Perspektive ist wenig spektakulär, aber realistisch. Ohne zeitliche Struktur bleibt selbst die beste Lernabsicht erfolglos. In der Praxis zeigt sich, dass selbstgesteuertes Lernen weniger an Motivation scheitert als an fehlender Planung. Die geplante Zeit allein reicht aber nicht – das Gelernte muss gesichert werden.

Review: Wiederholen mit System

Der letzte Schritt verweist auf Spaced Practice, also verteilte Wiederholung. Diese gilt als eine der robustesten Strategien für langfristiges Behalten. Entscheidend ist, dass Wiederholen nicht als passives Durchlesen verstanden wird, sondern als aktiver Abruf. Das bedeutet: Statt Notizen erneut zu lesen, versucht man, das Gelernte aus dem Gedächtnis zu rekonstruieren. Erst danach gleicht man es mit den Unterlagen ab. Bewährt haben sich Abstände von einem Tag, einer Woche und einem Monat nach dem ersten Lernen. FASTER bleibt hier bewusst offen, bietet aber einen klaren Hinweis: Lernen endet nicht mit dem ersten Verstehen. Für selbstgesteuertes Lernen ist diese Einsicht zentral, da Lernprozesse selten extern getaktet werden.

Einordnung und praktische Empfehlung

Aus pädagogischer Sicht ist FASTER kein vollständiges Modell selbstgesteuerten Lernens. Fragen der Zieldefinition, der Erfolgskontrolle oder des Transfers bleiben weitgehend ausgeklammert. Das Modell setzt voraus, dass man weiss, was man lernen will und warum. Diese Leerstelle ist relevant, schmälert aber nicht den praktischen Wert des Ansatzes. FASTER will nicht erklären, was Lernen ist, sondern Orientierung im Lernhandeln bieten.

Ich verstehe das FASTER-Modell als praxistaugliche Heuristik für selbstgesteuertes Lernen. Es ersetzt weder didaktische Konzepte noch wissenschaftliche Modelle, schafft aber einen klaren Rahmen für bewusste Lernentscheidungen. Seine Stärke liegt in der Konzentration auf Aufmerksamkeit, Aktivität und Wiederholung. Wer selbstgesteuert lernt, findet hier keine Abkürzung, aber eine strukturierte Erinnerung daran, worauf es ankommt.

Meine Empfehlung lautet daher: Nutze FASTER nicht als Methode, sondern als Checkliste. Dort, wo Lernen ins Stocken gerät, lohnt sich der Blick auf diese sechs Schritte:

- Forget: Habe ich Raum geschaffen, indem ich Vorwissen und Ablenkungen ausgeblendet habe?

- Act: Arbeite ich aktiv mit dem Stoff, statt nur zu lesen oder zuzuhören?

- State: Bin ich mir meines emotionalen und körperlichen Zustands bewusst?

- Teach: Kann ich das Gelernte in eigenen Worten erklären oder weitergeben?

- Enter: Habe ich feste Lernzeiten im Kalender eingetragen?

- Review: Wiederhole ich das Gelernte in verteilten Abständen durch aktiven Abruf?

💬 Kommentieren (nur für write.as-Accounts)

Literatur Jim Kwik (2021): Limitless. Wie du schneller lernst und dein Potenzial befreist. Gräfelfing: Next Level.

Bildquelle Jean-Étienne Liotard (1702–1789): Portrait de Marie-Adélaïde de France en tenue turque, Uffizien, Florenz, Public Domain.

Disclaimer Teile dieses Texts wurden mit Deepl Write (Korrektorat und Lektorat) überarbeitet. Für die Recherche in den erwähnten Werken/Quellen und in meinen Notizen wurde NotebookLM von Google verwendet. Die Übersichtsgrafik zum Modell wurde basierend auf meiner Inhaltsangabe von ChatGPT (GPT-5.2) generiert. Prompt: „Erstelle mir aus nachfolgendem Text eine Infografik, im Stil von Flipcharts in Trainings. Nutze ausschliesslich meinen Text und erstelle die Infografik im Querformat, weisser Hintergrund.“

Themen #Erwachsenenbildung | #Coaching

Tools That Change the Designer – An Introduction to how tools shape our thinking

from drpontus

1. INTRODUCTION

When we talk about “design tools,” we often mean software: Figma, Miro, prototyping platforms, and now AI-powered assistants. These tools promise efficiency and speed. But as Ivan Illich (1973) and Marshall McLuhan (1964) argue, tools are never neutral. They extend us — but also reshape us. They amplify capability –but can also amputate forms of thinking we no longer practice.

Modern designers sit inside a tool ecosystem that subtly determines how they think, not just what they produce. Recognizing this is the first step toward reclaiming agency and imagination.

2. ILlICH: WHEN TOOLS CROSS A THRESHOLD

Ivan Illich, in the essay book Tools for Conviviality (1973), makes a powerful distinction between tools that amplify human autonomy and tools that invert control — becoming systems that the user must adapt to. Illich argues tools have a threshold:

- Below the threshold, tools enhance freedom, skill, and creativity.

- Above the threshold, tools reorganize society around their own requirements.

At that point, tools become radical monopolies: infrastructures you must use because opting out means professional or social exile. Illich’s concern was not convenience, but autonomy:

- Does a tool leave room for personal initiative?

- Does it support diversity of approaches?

- Does it demand expert maintenance or corporate centralization?

- Does it enhance competence — or replace it?

Today’s proprietary LLM services and closed design ecosystems exhibit the traits Illich warned about:

- They require designers to work inside their assumptions.

- They centralize power in proprietary infrastructures.

- They encourage homogenized outputs and “best practice templates.”

- They replace certain forms of judgment, not by supporting them, but by overriding them.

The speed is seductive, but Illich would say: “speed becomes a trap if it funnels us toward mediocrity.”

A convivial tool, in Illich’s language, is one that:

- Is transparent

- Is user-controlled

- Supports skill rather than deskills

- Expands imaginative freedom

- Does not demand conformity to an external system

Pen and paper are convivial. A local sketching tool or a customizable design system may be convivial. A proprietary black-box AI? Mostly not.

3. McLUHAN: EVERY TOOL EXTENDS — AND AMPUTATES

Marshall McLuhan’s media theory (McLuhan, 1964) strengthens Illich’s warning. McLuhan famously wrote:

”Every technology is an extension of ourselves.”

The car extends the foot. The phone extends the voice. Figma extends the designer’s hand.

But less often quoted is McLuhan’s complement:

”Every extension also amputates part of ourselves.”

When we extend memory into cloud storage, we atrophy the ability to recall. When design tools automate layout, we risk dulling the intuition of composition. McLuhan invites us to ask:

• What capacities are extended?

• What capacities quietly shrink?

• What becomes unthinkable inside a given medium?

When a tool becomes ubiquitous, it becomes the environment. And when something becomes the environment, we stop noticing it — but it continues shaping us.

For today’s designers a number of questions need answering:

- What does tools like Figma make easy?

- What does it make invisible?

- What does an AI assistant normalize as “the right answer”?

- What forms of thinking are lost when starting with a template?

McLuhan’s insight:

”The logic of the medium becomes the logic of the mind.”

When LLM platforms set the default style, tone, and structure of design reasoning, the designer’s imagination risks becoming an echo of the system.

4. PALLASMAA: THINKING WITH THE HAND

Juhani Pallasmaa expands this in The Thinking Hand. He argues that embodied cognition — thinking through gesture, pressure, texture, speed — is not primitive but foundational:

- Sketching produces ambiguity, which fuels discovery.

- The resistance of materials slows thinking into deeper awareness.

- Physical marks reveal the mind’s hesitations and possibilities.

Digital tools erase resistance. They flatten differences. They tidy too quickly.

Pallasmaa says that the hand “thinks” in ways the conscious mind cannot.

When design begins in high-fidelity tools:

- Ambiguity collapses.

- The premature clarity limits imagination.

- Exploration is replaced by refinement.

This is why early-stage ideas should emerge from tools that introduce friction, not ones that algorithmically smooth it away.

5. NIGEL CROSS: DESIGN AS A WAY OF KNOWING

Nigel Cross (2001) reminds us that design is not just visual production — it is a mode of inquiry. Designers generate knowledge by:

- externalizing ideas

- iterating through representations

- constructing and reframing problems

- engaging in reflective dialogue with the materials at hand

But if the “material at hand” is a software environment that:

- prescribes structure,

- assumes best practices,

- autofills patterns,

- or suggests solutions before the designer thinks…

…then the mode of inquiry itself is altered.

Cross emphasizes that designers must maintain intentionality — choosing representations that allow them to think, not representations that tell them what to think.

6. SUMMARY

When Illich, McLuhan, Pallasmaa, and Cross are placed together, a clear picture emerges:

Illich: Tools must remain within human scale and control — or they reshape us.

McLuhan: Every tool subtly rewires our cognitio — extending and amputating.

Pallasmaa: Embodied, physical making produces deeper imagination than screen-first workflows.

Cross: Design knowledge emerges from intentional, exploratory representation — not templates.

Together, they form the intellectual backbone for the aware design professional:

Speed-driven tools funnel designers toward the average. Convivial, human-scale tools expand imagination and autonomy.

Choosing pen and paper, sketching, tangible prototyping, local tools, or open toolchains is not conservative nostalgia. It is convivial resistance — deliberately designing the conditions in which original thinking can occur.

As you reflect on your current tools, ask:

What aspect of my thinking is this tool extending?

What aspect is it amputating?

What assumptions does it normalize?

Does it encourage diversity or conformity?

Does it amplify my competence — or replace it?

Can I alter the tool — or must I adapt to it?

Does using this tool make me feel more autonomous — or more dependent?

Your goal is of course not to abandon digital tools — but to see them clearly, and to choose intentionally rather than habitually.

References

- Cross, N. (2001). Designerly ways of knowing: design discipline versus design science. Design Issues, 17(3) pp. 49–55.

- Illich, I. (1973). Tools for conviviality. Calder and Boyars, London.

- McLuhan, M. (1964). Understanding Media. https://mcluhan.org/understanding-media/

- Pallasmaa, J. The Thinking Hand: Existential and Embodied Wisdom in Architecture (2009). Wiley. https://www.wiley.com/en-us/The+Thinking+Hand%3A+Existential+and+Embodied+Wisdom+in+Architecture-p-9780470779293

from Tech Immortal

Tech Immortals

Tech Immortals is a custom software development company in noida dedicated to building reliable digital products that help businesses scale with confidence.

We focus on creating technology that solves real operational challenges while supporting long term growth. Our approach combines strategic thinking, modern engineering, and clear communication. Every solution we build is designed for performance, security, and adaptability. We work closely with startups, growing companies, and enterprises to transform ideas into dependable software systems. At Tech Immortals, technology is not built for today alone. It is engineered to remain relevant, stable, and effective as businesses evolve and markets change.

Our Identity and Approach We are a team of engineers, designers, and technology consultants who believe strong software begins with understanding the business behind it. Before development starts, we invest time in learning goals, workflows, and constraints. This ensures every product is aligned with real needs rather than assumptions. Transparency and collaboration guide our work. Clients stay informed at every stage, allowing faster decisions and better outcomes. We operate as long term partners, not short term vendors, supporting growth well beyond initial delivery.

Vision and Mission Our vision is to become a trusted global technology partner known for building scalable and future ready digital solutions. We aim to help organizations adapt to change through dependable software products that grow with them.

Our mission is to simplify complex processes through thoughtful design, efficient development, and practical engineering. We focus on delivering measurable results by creating systems that improve productivity, user experience, and operational clarity across industries.

Our Core Services We offer a comprehensive range of development services tailored to diverse business needs.

Custom Software Development: We design and build tailored software solutions that address specific business challenges and improve operational efficiency.

Mobile App Development: We create high performance iOS and Android applications focused on usability, stability, and seamless user engagement.

Web Development: We develop responsive and scalable websites and web applications optimized for speed, accessibility, and modern user expectations.

Game Development: We build interactive and immersive gaming experiences designed for engagement, performance, and creative storytelling.

3D Design Development: We deliver high quality 3D visuals and interactive assets that enhance digital experiences and product representation.

Software Integration and Migration: We connect systems and migrate platforms smoothly while maintaining data integrity and minimizing operational disruption.

Software Maintenance and Support: We provide continuous monitoring, updates, and performance optimization to ensure long term reliability and security.

Each service is delivered with careful planning, technical precision, and a focus on sustainable growth.

Our Development Process Our development process balances structure and flexibility to ensure quality delivery and long term reliability.

Step 1: Plan and Design: Define goals, scope, and user needs through structured analysis and thoughtful design.

Step 2: Build and Test: Develop scalable code with continuous testing to ensure performance, security, and reliability.

Step 3: Launch and Support: Deploy confidently, monitor systems, deliver updates, and provide ongoing support post launch.

Why Businesses Choose Tech Immortals Choosing the right technology partner goes beyond technical skills. Businesses look for clarity, reliability, and long term alignment. At Tech Immortals, we focus on building trust through consistent delivery, clear communication, and solutions that support real business outcomes.

Clarity at Every Stage: We maintain transparent communication from planning to delivery, ensuring clients always understand progress, decisions, and next steps.

Accountability You Can Rely On: We take ownership of our work, meet commitments, and remain responsible for quality, performance, and timelines.

Solutions Built for Growth: Our software is designed to scale, adapt, and evolve as business needs change, reducing future rework and technical debt.

Continuous Improvement Mindset: We refine, optimize, and enhance solutions over time, ensuring systems remain efficient, secure, and aligned with business goals.

Our Commitment We believe successful software is built on trust and consistency. From discovery to post launch support, we stay actively involved. We guide clients through decisions, maintain clear timelines, and adapt solutions as needs evolve. At Tech Immortals, every project is an opportunity to create durable value through thoughtful technology, strong partnerships, and software built to perform reliably for years to come.

Conclusion Tech Immortals partners with businesses to build reliable, scalable software that delivers lasting value. We combine strategy, engineering, and clarity to solve real challenges and support long term growth. If you are ready to transform ideas into dependable digital products, connect with Tech Immortals and start building technology designed to grow with your business with confidence, speed, and measurable results.

Reborn like a butterfly 🦋

from  The happy place

The happy place

There’s this pub just a stone throw away where my wife and I go sometimes for a Guinness, or like yesterday, two.

It’s the new version of myself: a bakery bread eating city man with clipped toe nails who does yoga. A type of artist with a wide stance and a lazy eye.

I love 🇫🇷 France!

I feel this metamorphosis where I am becoming the butterfly version of myself.

Have I become my father?

A driving thought

from  Talk to Fa

Talk to Fa

I was driving on winding mountain roads. I’d lowered the gear and opened the windows slightly to let the fresh air in. The trees had been burnt by the fire. The air was crisp. The fire must have brought a renewal to the area. As I slowed down to let a deer cross, I wondered whether people like me, natural explorers, travel to new places in search of our true homes and soul families. I recently read somewhere that most of us live in environments that are not suited for our unique designs. The deer stopped and looked straight into my eyes. I felt seen and somehow validated for the thought.

Niet in slaap kunnen vallen door negatieve gedachten en wat je dromen echt betekenen (10/40)

from tomson darko

(en ze sliep nog kort en onrustig)

Er zijn mensen die slechts hun hoofd op het kussen hoeven te leggen en weg zijn ze. Naar dromenland.

Andere zielen, zoals ik, hebben die gave van een snelle slaaplatentie niet.

Nee.

In het slechtste geval komt bij mij ook nog eens de nachtburgemeester langs.

Je weet wel.

Die stem die je even gaat vertellen hoe stom je leven is, hoe stom je zelf bent en hoe stom je je hebt gedragen.

Volgens Fernando Pessoa (1888–1935) bestaan de monsters uit je kindertijd echt.

Ze zitten alleen niet onder het bed. Ze duiken op in je hoofd als gedachten, als de slaap ’s nachts niet komt.

Gemeen. Rottend. Onheilspellend.

Hij schrijft in Het boek der rusteloosheid:

Ze zijn ballast van het bedrog en hebben als enige nut ons een gevoel van nutteloosheid te geven.

Ik herken zijn woorden volledig.

Al die beelden die je gedachten maar oproepen.

Van wat ooit was.

Van wat nooit in je leven gaat gebeuren.

Gezichten waar je dagelijks tegenover zat, maar nu een schim zijn geworden.

Die ene persoon met die slanke polsen die je eenmalig op een feestje sprak, maar nog steeds dagelijks in je hoofd verder leeft als een onvervuld verlangen.

Al mijn zorgen blijken ’s nachts erger dan ik me ooit kon voorstellen. Mijn positieve zelfbeeld is niets meer van over. De toekomst gaat sowieso gebeuren. Maar leuk zal het niet zijn. Eerder ondraaglijk en gemeen.

Tot die ene gedachte opkomt: waarom leef ik überhaupt nog?

Ja.

Mijn hoofd houdt van drama.

De enige remedie die echt helpt, is gewoon in slaap vallen. Zodat het sneller ochtend is.

Daglicht laat monsters verdwijnen.

==

Hoe meer ontspannen je dag, hoe rustiger je slaapt, zeggen ze. Maar het zijn niet de negatieve gedachten die ik het meest vrees.

Nee.

Als de slaap wel eerder komt, zijn het de dromen die zo rusteloos zijn.

Weinig heldere herinneringen meer uit mijn kindertijd. Maar de dromen uit die tijd zie ik nog precies zo voor me.

Monsters onder het bed? Bij mij stond die naast het bed.

Een reus.

Ik op mijn zij, spiekend naar de muur, doen alsof ik ‘sliep’, zodat de reus weer verder kon gaan met wat die ook aan het doen was.

Waarschijnlijk kwam deze reus direct uit de verfilming van De GVR (1989), naar het boek van Roald Dahl (1916–1990), gelopen. De grote vriendelijke reus die door de straten van een dorp stapt en door de ramen naar binnen kijkt naar slapende kinderen.

Bibbers.

(Ik weiger ook nog steeds de Steven Spielberg-verfilming (2016) van dit boek te bekijken. Bang dat hij mijn nachtmerrie werkelijkheid heeft gemaakt.)

==

Aantekening uit mijn gedachtenlog van laatst:

‘Gedroomd over in een auto te zitten, links achterin, achter de bestuurder. De vrouwelijke bestuurster wilde het water in rijden. Ik begon na haar uitspraak al te hyperventileren. Een paniekaanval krijgen in mijn droom, dat was nieuw. Ik bleef maar “nee, niet doen” roepen, in de hoop dat ze het stuur niet richting het water gooide.’

Wist je dat wij niet onze dromen hoeven te interpreteren, maar dat onze droomwereld ons probeert te begrijpen?

Volgens slaapexpert Matthew Walker (1972) dromen we om onze ervaringen van overdag los te koppelen van de emotie die we daarbij voelden.

We dromen om te verwerken. Om emoties zachter te maken bij een herinnering.

Daarom zijn dromen een gekke mengelmoes van wat we overdag hebben gezien, aangevuld met vreemde fantasieën. Want we stoppen niet met denken. Ook niet als we slapen.

Dit mechanisme wordt een probleem bij traumatische gebeurtenissen. Hoe erg het brein ook zijn best doet, de emotie wordt maar niet losgekoppeld van het incident.

Dit is waarom mensen met PTSS blijven dromen over hun trauma’s. Het brein wil loskoppelen, maar slaagt daar niet in.

Het voert elke keer opnieuw de horrorbeelden op.

=

Je nachtdromen zijn metaforen.

Ze geven geen kijkje in je toekomst. Ze onthullen niets over je verleden. Ze gaan over je huidige worstelingen in het leven.

Maar die kun je alleen begrijpen als je de rationele wereld even loslaat en via de lens van symboliek kijkt.

Dat is de wereld van de poëten.

Ons onderbewustzijn is een dichter en jij de vertaler.

Die denkt niet in woorden en logica. Die denkt in beelden. Omdat beelden ouder zijn dan het geschreven woord.

Via beelden probeert het jouw leven te begrijpen.

Begrijp je die beelden, dan begrijp je jezelf beter. Misschien lukt het je zelfs om tot een conclusie te komen.

Ik droom zelf regelmatig dat ik nog een examen moet doen. Of een variant daarop. Dat ik ‘betrapt’ word op het niet volledig behalen van mijn diploma en mensen me daar met de nek op aankijken.

In mijn dromen voel ik me verward en bang dat ik ga falen voor mijn herexamen en zo nooit zal slagen.

Best vreemd eigenlijk. Want ik heb nooit faalangst gekend voor school.

Maar waarom deze terugkerende droom?

De enige manier om mijn droom te onderzoeken, is de metaforen erin zien en daarover nadenken.

De school als metafoor voor kennis en leren. Het examen als metafoor voor de angst om te falen in het leven. Een nu-of-nooitmoment.

Als ik erover nadenk, kan ik het koppelen aan wat ik elke dag doe.

Namelijk schrijven en mijn werk publiceren.

Mijn grootste angst is dat dit fulltime kunstenaarschap niet gaat lukken. Dat er geen geld meer binnenkomt en ik genoodzaakt ben om vakken te vullen bij de Action.

Dat heeft mijn droomwereld feilloos door.

Dus wat is de les van deze droom?

Waarom zo bang zijn om te falen, terwijl ik ondertussen elke dag leer?

Alles wat ik nu doe, zal niet voor niets zijn. Zelfs als het financieel niet lukt, heb ik ervaring opgedaan die ik ergens anders kan inzetten.

Die droom waarin ik linksachterin de auto zit, gaat over het ontbreken van controle. Het water als symbool voor de diepte van de ziel.

Wanneer durf ik mezelf volledig over te geven aan het schrijverschap? Altijd die drang naar controle. Altijd de angst dat het niet werkt zoals ik wil.

Wanneer komt die volledige overgave?

Het begrijpen van je dromen vraagt oefening. Schrijf na het wakker worden de beelden op. De symbolen. Je zult merken dat je, bijna als een dichter, betekenis begint te geven aan wat je ziet. Niet omdat er één juiste uitleg bestaat, maar omdat elke associatie iets zegt over waar je nu staat.

Dromen zijn ook geen raadsels die opgelost moeten worden. Ze zijn spiegels. Het zijn pogingen van je onderbewuste om jou serieus te nemen.

De vraag is: wanneer begin jij jezelf eens serieus te nemen?

Liefs,

tomson

De kunst van het loslaten bestaat niet (9/40)

from tomson darko

Ik kan geen emoties aan of uitzetten.

Het is meer dat emoties me op een dag gewoon verlaten. Slapen helpt goed tegen een stomme opmerking van een vreemdeling op straat bij een druk kruispunt.

Slapen helpt nauwelijks bij de grote littekens van het leven. Zoals het einde van relaties, werk of vriendschappen.

Ik kan me nog goed herinneren waar mijn telefoon lag. Op de kast in de donkere gang. Het scherm flikkerde op. Zijn naam zichtbaar.

Hij appte me in een vrij kort bericht dat hij het contact verbrak en een boek terug wilde hebben. Dat hij er klaar mee was, snapte ik wel. Ik had geen zin meer om hem te helpen met het zoveelste project dat hij toch niet ging afmaken. Ik was druk met mijn eigen projecten en met werk.

Het was natuurlijk niet mijn laatste ‘nee’ die dit veroorzaakte. Het waren jaren van ingewikkelde ruzies en teleurstellingen in elkaar.

Wellicht was het beter zo.

Maar het steekt wel, zo’n app.

En hoewel de relatie stopte, stopt het niet in het hoofd.

Herinneringen worden jarenlang op willekeurige momenten geactiveerd.

Van inside jokes tot het lezen van artikelen waar hij vast ook veel aan had gehad.

Het gesprek start weliswaar in het hoofd met hem door het zien van een goede video-essay. Er is alleen niets meer in de fysieke wereld om het gesprek mee af te maken.

En dan, in de jaren die volgen, worden de herinneringen minder en minder. Zelfs het gevoel van gemis dooft.

Geen zalvende gedachten meer over hoe het allemaal was gekomen. Geen gevoelens van spijt en schaamte meer.

Hij was in mijn hoofd een gelijke geworden met al die klasgenoten van de basisschool. Je had er acht jaar van je leven mee gedeeld. Maar hoe ouder je wordt, hoe minder betekenisvol die relaties nog aanvoelen.

Dacht ik...

Kun je überhaupt wel ontsnappen aan je verleden? Soms lijkt alles wat ik meemaak een echo van vroeger.

Ik kwam hem tegen.

Utrecht Centraal. Van al die duizenden mensen die daar in en uit lopen, zag ik hem meteen. Met een vrouw. Duidelijk een van de eerste dates. Ze lachten en plaagden elkaar wat af. Ze leken blij met elkaar.

Hij was niets veranderd.

Dat gevoel, meteen in de buik: angst. Dat gevoel, meteen om weg te rennen. Het gevoel van schaamte over hoe dingen waren gelopen. Maar geen behoefte aan een gesprek. Geen behoefte aan dingen af te sluiten.

Ik weet niet eens waarom. Misschien omdat ik niets te melden had als we aan de praat zouden raken.

Ik deed geen poging om oogcontact te zoeken. Ik liep in snellere pas door naar mijn perron.

Wat nog te zeggen, behalve zelfopgeklopte kletspraat over hoe geweldig het met me ging?

Alsof het ertoe deed.

Maar ja.

Deze ontmoeting liet de dagen die volgden alle emoties weer activeren. Weliswaar trok het ook vrij snel weer weg. Maar ze waren er wel weer. Net zo sterk aanwezig.

Het concept loslaten heb ik nooit begrepen.

Het is geen knop.

Emoties komen. Sommige blijven. Enkelen vertrekken. En de meest intense keren nog wel weer een keertje terug in de toekomst.

Er zijn natuurlijk wel manieren om dat ‘loslaten’ te versoepelen.

Soms helpt praten over iets me om een sterk gevoel te verzachten. Dan voel ik me meteen lichter na het gesprek.

Soms helpt schrijven me iets. Gewoon opschrijven en dan erachterkomen waarom ik me nou voel zoals ik me voel.

Maar dit geldt gewoon niet voor de zware dingen van het leven. Althans, niet bij mij.

Ik kon jarenlang geen zinnig woord opschrijven over de woningbrand.

Wat viel er te zeggen?

En nu ik het meer dan tien jaar later toch heb geprobeerd, in fictievorm, durf ik het niet te publiceren.

Niet elke ervaring die je op papier zet verandert je.

==

Loslaten suggereert dat je het actief kunt doen. Zoals uit een vliegtuig springen met een parachute op je rug.

Maar ik vind loslaten vooral een reactieve beleving.

Jij springt niet. De instructeur springt en jij zit eraan vast.

Tijd heelt niet. Met een beetje geluk laat tijd iets slijten.

Tot er weer iets gebeurt en dan zijn alle emoties en gevoelens en gedachten weer volledig terug.

Ik wantrouw mensen die zeggen over hun ex heen te zijn. Alleen al dat je dit zegt, suggereert iets anders.

Dat ben je niet. Je hebt gewoon een modus gevonden waarin het je even niet meer zo martelt. Gelukkig maar.

Maar niemand is veilig voor de toekomst.

Ik bezocht niet zo lang geleden een open dag van de vrijwillige brandweer. Puur toeval. Het was naast een winkelcentrum waar ik tape moest halen voor het versturen van pakketjes.

Een jaar na de brand kreeg ik tranen in mijn ogen en een brok in mijn keel als ik een brandweerauto door een straat zag rijden. Nu, meer dan tien jaar later, voelde ik niks bij afgaande sirenes ter demonstratie. Gewoon wagens en slangen en mannen en vrouwen in brandweerkleding.

Tot ik een kraam tegenkwam met tips voor wat te doen in de woning rondom brand.

- Doe altijd je deur dicht als je slaapt.

- Zorg voor een hoorbare brandmelder.

- Zet een deksel op de pan als het vlam vat.

De rest van de tips heb ik niet kunnen lezen van deze afstand. Ik durfde het kraampje niet te bezoeken. Ik liep er letterlijk met een grote boog omheen. Ik wilde niet aangesproken worden. Ik wilde geen foldertje bekijken. Ik wilde niet denken aan dat het me nog een keer kan overkomen.

Dat is het stomme aan verdriet.

Al ons leed kan ons nog een keer overkomen. Maar we proberen te leven met het idee dat het ons niet nog een keer gaat gebeuren. Want anders overheerst de angst. En dat is ook geen leven.

Of je wil of niet, verdriet blijft met je meewandelen.

Het leven is leven met verdriet.

Ik voel het nu in mijn hartstreek, die brand, bij het schrijven van deze woorden.

Omdat er een leven ervoor en een leven erna was. Het voelt nog steeds heftig.

Het, wat dat ook moge zijn, zit nog steeds ergens in me verborgen.

‘Verdriet komt op plekken waar woorden niet kunnen komen,’ schreef ik een tijdje geleden op.

Ik denk dat ik nu pas die zin volledig begrijp.

Loslaten is een woord.

Maar gevoelens laten zich niet zo makkelijk leiden door woorden. Ze verdwijnen niet door woorden.

Ze worden in beweging gebracht. Maar dat is iets anders dan verdwijnen.

Er is geen formule voor loslaten. Het is veel mystieker.

Ik weet dat tijd een beetje helpt.

Het haalt de scherpe randjes eraf.

Tot je in een soortgelijke situatie belandt.

Dan zijn al die begraven gevoelens weer levendig.

Ik weet ook dat gevoelens soms opeens volledig verdwenen kunnen zijn.

Geen woede meer. Geen verdriet. Niet eens een vorm van begrip.

Geen idee wat dit veroorzaakt. Maar het waren geen woorden.

Wat zeker niet helpt, is de pijn blijven opzoeken. De relatie koste wat kost in stand houden.

Als ik je een advies mag geven: ontvolg, blokkeer desnoods, stop met reageren, stop met dingen sturen, stop met praten.

Maar dat is makkelijker gezegd dan gevoeld. Want er is altijd iets in ons dat hoopt. Op verzoening. Op vergeving. Op antwoorden. Op afsluiting. Op het idee dat de cirkel rondmaken bevrijding geeft.

Ik wou dat het leven zo simpel was.

Dat gevoelens zich zo makkelijk lieten temmen.

Nee.

Die gaan op plekken zitten waar je weinig controle over hebt.

Die komen naar boven op momenten waarop je het niet verwacht.

Ze zijn soms zo sterk dat je het niet eens aan een ander kunt uitleggen wat je ziet en ervaart en voelt. Dat je nog steeds van iemand houdt die je zoveel pijn heeft gedaan. Dat het nog steeds voelt alsof die persoon naast je zit. Dat je zo diep gekwetst bent dat je geen oogcontact meer met ze kunt maken, hoe kinderachtig dat ook voor een buitenstaander overkomt.

Verdriet kan niet losgelaten worden.

Want het houdt jou vast.

Je kunt alleen hopen.

Hopen dat het op een dag uiteindelijk jou loslaat.

Maar er is geen formule. Het is veel mystieker.

Wat niet heeft geholpen is het boek nooit terugsturen van die vriend. Ik heb het weggegooid.

Ik weet het. Kinderachtig. En dat blijft me achtervolgen in mijn hoofd. Dat dat niet had gehoeven. En dat blijft me nu martelen. Elke keer weer als ik een artikel zie dat verwijst naar dat boek of de verfilming daarvan is daar weer het schuldgevoel.

We doen soms rare dingen als we ons gekwetst voelen.

The fun internet is dead

from  a.nihil

a.nihil

Two decades ago, logging into the internet meant a lot of possibilities. You could download music for free, chat rooms gave this rush of talking to strangers across the world and there was this grungy aspect of surfing websites and finding weird corners of the internet that gave both you and the internet a personality. Then, this “e”-world seemed like a novelty, mass adoption where a life without it was impossible felt like a dream one would brush away. Then the first social networks emerged and the iPhone and its many clones, followed by cheap data to the point where now being plugged into the global economy means being connected by 4 devices but the whole experience of the internet revolves around a handful of platforms and a few apps.

It is fair that the initial wonder of the internet has faded away into oblivion, it was too good to be true. To reach the economies of scale meant that standardization was inevitable, which induces the feeling of sameness but still there was the element of adding ones own personal touches to the experience of the internet. With generative AI this has changed, the last frontier of personalization on the internet has also become automated which means that every post reads the same, every video looks like a copy of a copy of a copy.

Plus, why would anyone want to create on the internet anyway? The obvious money incentive which means that certain norms have to be adhered to: You can't be too left, can't question the overlords or stirrup trouble. But otherwise with the surveilling apparatus baked deep into the experience of the web, we're just giving more data points to allow ourselves to be policed. Gen AI also means that one's content becomes the fodder for another model of your favorite LLM, further diluting the incentives to create. So the best way to enjoy the internet is as a mute spectator, a consumer rather than a creator. The internet is killing itself and us along with it and we aren't even noticing. Or maybe we aren't supposed to.

#internet #deadinternet #AI

Eye Robot

from  Happy Duck Art

Happy Duck Art

An eyedea, which I don’t have the skill to bring to fruition yet, but putting it here for the future when maybe I will have more ability.

The Disappearing Blockchain: Crypto's Greatest Success

from  SmarterArticles

SmarterArticles

The stablecoin transaction that moved $2 billion from Abu Dhabi to Binance in May 2025 looked nothing like what the cypherpunks imagined when they dreamed of digital money. There were no anonymous wallets, no cryptographic rituals, no ideological manifestos. MGX, a sovereign wealth vehicle backed by the United Arab Emirates, simply wired funds denominated in USD1, a stablecoin issued by World Liberty Financial, a company affiliated with the family of the sitting United States President. The transaction settled on blockchain rails that neither party needed to understand or even acknowledge. The technology had become invisible. The revolution had been absorbed.

This moment crystallises the central tension now confronting the cryptocurrency industry as it enters what many are calling its institutional era. Stablecoins processed over $46 trillion in transactions during 2025, rivalling Visa and PayPal in volume. BlackRock's Bitcoin ETF surpassed $100 billion in assets under management, accumulating over 800,000 BTC in less than two years. The GENIUS Act became the first major cryptocurrency legislation passed by Congress, establishing federal standards for stablecoin issuers. Tokenised real-world assets reached $33 billion, with projections suggesting the market could hit $16 trillion by 2030. By every conventional measure, cryptocurrency has succeeded beyond its founders' wildest projections.

Yet success has arrived through a mechanism that would have horrified many of those founders. Crypto went mainstream by becoming invisible, as the a16z State of Crypto 2025 report observed. The technology that was supposed to disintermediate banks now powers their backend operations. The protocol designed to resist surveillance now integrates with anti-money laundering systems. The culture that celebrated pseudonymity now onboards users through email addresses and social logins. The question is whether this represents maturation or betrayal, evolution or erasure.

The Infrastructure Thesis Ascendant

The economic evidence for the invisibility approach has become overwhelming. Stripe's $1.1 billion acquisition of Bridge in February 2025 represented the payments industry's first major acknowledgement that stablecoins could serve as mainstream infrastructure rather than speculative instruments. Within three months, Stripe launched Stablecoin Financial Accounts across 101 countries, enabling businesses to hold balances in USDC and USDB while transacting seamlessly across fiat and crypto rails. The blockchain was there, handling settlement. The users never needed to know.

This pattern has repeated across traditional finance. Visa partnered with Bridge to launch card-issuing products that let cardholders spend their stablecoin balances at any merchant accepting Visa, with automatic conversion to fiat happening invisibly in the background. Klarna announced plans to issue its own stablecoin through Bridge, aiming to reduce cross-border payment costs that currently total roughly $120 billion annually. The fintech giant would become the first bank to tap Stripe's stablecoin stack for blockchain-powered payments, without requiring its customers to understand or interact with blockchain technology directly.

BlackRock has been equally explicit about treating cryptocurrency as infrastructure rather than product. Larry Fink, the firm's chief executive, declared following the Bitcoin ETF approval that “every stock and bond would eventually live on a shared digital ledger.” The company's BUIDL fund, launched on Ethereum in March 2024, has grown to manage over $2 billion in tokenised treasury assets. BlackRock has announced plans to tokenise up to $10 trillion in assets, expanding across multiple blockchain networks including Arbitrum and Polygon. For institutional investors accessing these products, the blockchain is simply plumbing, no more visible or culturally significant than the TCP/IP protocols underlying their email.

The speed of this integration has astonished even bullish observers. Bitcoin and Ethereum spot ETFs accumulated $31 billion in net inflows while processing approximately $880 billion in trading volume during 2025. An estimated 716 million people now own digital assets globally, a 16 percent increase from the previous year. More than one percent of all US dollars now exist as stablecoins on public blockchains. The numbers describe a technology that has crossed from interesting experiment to systemic relevance.

The regulatory environment has reinforced this trajectory. The GENIUS Act, signed into law in July 2025, establishes stablecoin issuers as regulated financial entities subject to the Bank Secrecy Act, with mandatory anti-money laundering programmes, sanctions compliance, and customer identification requirements. Payment stablecoins issued under the framework are explicitly not securities or commodities, freeing them from SEC and CFTC oversight while embedding them within the traditional banking regulatory apparatus. The Act requires permitted issuers to maintain one-to-one reserves in US currency or similarly liquid assets and to publish monthly disclosure of reserve details. This is not the regulatory vacuum that early cryptocurrency advocates hoped would allow decentralised alternatives to flourish. It is integration, absorption, normalisation.

The Cultural Counter-Argument

Against this backdrop of institutional triumph, a parallel ecosystem continues to thrive on explicitly crypto-native principles. Pump.fun, the Solana memecoin launchpad, has facilitated the creation of over 13 million tokens since January 2024, generating more than $866 million in lifetime revenue by October 2025. At its peak, the platform accounted for nearly 90 percent of all token mints on Solana and over 80 percent of launchpad trading volume. Its July 2025 ICO raised $1.3 billion in combined private and public sales, with the $PUMP presale hauling in $500 million in minutes at a fully diluted valuation of approximately $4 billion.

This is not infrastructure seeking invisibility. This is spectacle, culture, community, identity. The meme coin total market capitalisation exceeded $78 billion in 2025, with projects like Fartcoin briefly reaching $2.5 billion in valuation. These assets have no intrinsic utility beyond their function as coordination mechanisms for communities united by shared jokes, aesthetics, and speculative conviction. They are pure culture, and their continued prominence suggests that crypto's cultural layer retains genuine economic significance even as institutional rails proliferate.

The mechanics of attention monetisation have evolved dramatically. In January 2025, a single social media post about the $TRUMP token, launched through a one-click interface on Solana, generated hundreds of millions in trading volume within hours. This represented something genuinely new: the near-instantaneous conversion of social attention into financial activity. The friction that once separated awareness from action has been reduced to a single tap.

Re7 Capital, a venture firm that has invested in Suno and other infrastructure projects, launched a $10 million SocialFi fund in 2025 specifically targeting this intersection of social platforms and blockchain participation. As Luc de Leyritz, the firm's general partner, explained: “For the first time in five years, we see a structural opportunity in early-stage crypto venture, driven by the convergence of attention, composability and capital flows in SocialFi.” The thesis is that platforms enabling rapid conversion of social attention into financial activity represent the next major adoption vector, one that preserves rather than erases crypto's cultural distinctiveness.

Farcaster exemplifies this approach. The decentralised social protocol, backed by $150 million from Paradigm and a16z, has grown to over 546,000 registered users with approximately 40,000 to 60,000 daily active users. Its defining innovation, Farcaster Frames, enables users to mint NFTs, execute trades, and claim tokens directly within social posts without leaving the application. This is not crypto becoming invisible; this is crypto becoming the medium of social interaction itself. The blockchain is not hidden infrastructure but visible identity, with on-chain activities serving as signals of community membership and cultural affiliation.

The tension between these approaches has become central to debates about crypto's future direction. Vitalik Buterin, Ethereum's co-founder, addressed this directly in a New Year's message urging the community to focus on building applications that are “truly decentralised and usable” rather than “winning the next meta.” He outlined practical tests for decentralisation: Can users keep their assets if the company behind an application disappears? How much damage can rogue insiders or compromised front-ends cause? How many lines of code must be trusted to protect users' funds?

These questions expose the gap between infrastructure and culture approaches. Invisible blockchain rails, by definition, rely on intermediaries that users must trust. When Stripe converts stablecoin balances to fiat for Visa transactions, when BlackRock custodies Bitcoin on behalf of ETF holders, when Klarna issues blockchain-powered payments, the technology may be decentralised but the user experience is not. The cypherpunk vision of individuals controlling their own keys, verifying their own transactions, and resisting surveillance has been traded for convenience and scale.

The Cypherpunk Inheritance

To understand what is at stake requires revisiting cryptocurrency's ideological origins. Bitcoin was not born in a vacuum; it emerged from decades of cypherpunk research, debate, and experimentation. The movement's core creed was simple: do not ask permission, build the system. Do not lobby politicians for privacy laws; create technologies that make surveillance impossible. Every point of centralisation was understood as a point of weakness, a chokepoint where power could be exercised by states or corporations against individuals.

Satoshi Nakamoto's 2008 whitepaper directly reflected these principles. By combining cryptography, decentralised consensus, and economic incentives, Bitcoin solved the double-spending problem without requiring a central authority. The vision was censorship-resistant money that allowed individuals to transact privately and securely without permission from governments or corporations. Self-custody was not merely an option but the point. The option to be your own bank, to verify rather than trust, remained open to anyone willing to exercise it.

The cypherpunks were deeply suspicious of any centralised authority, whether government agency or large bank. They saw the fight for freedom in the digital age as a technical problem, not merely a political one. Privacy, decentralisation, self-sovereignty, transparency through open-source code: these were not just preferences but foundational principles. Any compromise on these fronts represented potential capture by the very systems they sought to escape.

The success and commercialisation of Bitcoin has fractured this inheritance. Some argue that compliance with Know Your Customer requirements, integration with regulated exchanges, and accommodation of institutional custody represents necessary compromise to bring cryptocurrency to the masses and achieve mainstream legitimacy. Without these accommodations, Bitcoin would remain a niche asset forever locked out of the global financial system.

For the purist camp, this represents betrayal. Building on-ramps that require identity verification creates a surveillance network around technology designed to be pseudonymous. It links real-world identity to on-chain transactions, destroying privacy. The crypto space itself struggles with centralisation through major exchanges, custodial wallets, and regulatory requirements that conflict with the original vision.

By 2025, Bitcoin's price exceeded $120,000, driven substantially by institutional adoption through ETFs and a maturing investor base. BlackRock's IBIT has accumulated holdings representing 3.8 percent of Bitcoin's total 21 million supply. This is not the distributed ownership pattern the cypherpunks envisioned. Power has concentrated in new hands, different from but not obviously preferable to the financial institutions cryptocurrency was designed to circumvent.

Decentralised Social and the Identity Layer

If invisible infrastructure represents one future and pure speculation another, decentralised social platforms represent an attempt at synthesis. Lens Protocol, launched by the team behind the DeFi lending platform Aave, provides a social graph enabling developers to build applications with composable, user-owned content. Running on Polygon, Lens offers creators direct monetisation through subscriptions, fees from followers, and the ability to turn posts into tradable NFTs. Top users on the protocol average $1,300 monthly in creator earnings, demonstrating that blockchain participation can generate real economic value beyond speculation.

The proposition is that social identity becomes inseparable from on-chain identity. Your follower graph, your content, your reputation travel with you across applications built on the same underlying protocol. When you switch from one Lens-based application to another, you bring your audience and history. No platform can deplatform you because no platform owns your identity. This is decentralisation as lived experience rather than backend abstraction.

Farcaster offers a complementary model focused on protocol-level innovation. Three smart contracts on OP Mainnet handle security-critical functions: IdRegistry maps Farcaster IDs to Ethereum custody addresses, StorageRegistry tracks storage allocations, and KeyRegistry manages application permissions. The infrastructure is explicitly on-chain, but the user experience has been refined to approach consumer-grade accessibility. Account abstraction and social logins mean new users can start with just an email address, reducing time to first transaction from twenty minutes to under sixty seconds.

The platform's technical architecture reflects deliberate choices about where blockchain visibility matters. Storage costs approximately seven dollars per year for 5,000 posts plus reactions and follows, low enough to be accessible but high enough to discourage spam. The identity layer remains explicitly on-chain, ensuring that users maintain control over their credentials even as the application layer becomes increasingly polished.

The engagement metrics suggest these approaches resonate with users who value explicit blockchain participation. Farcaster's engagement rate of 29 interactions per user monthly compares favourably to Lens's 12, indicating higher-quality community even with smaller absolute numbers. The platform recently achieved a milestone of 100,000 funded wallets, driven partly by USDC deposit matching rewards that incentivise users to connect their financial identity to their social presence.

Yet the scale gap with mainstream platforms remains vast. Bluesky's 38 million users dwarf Farcaster's half million. Twitter's daily active users number in the hundreds of millions. For crypto-native social platforms to represent a meaningful alternative rather than a niche experiment, they must grow by orders of magnitude while preserving the properties that differentiate them. The question is whether those properties are features or bugs in the context of mainstream adoption.

The Stablecoin Standardisation

Stablecoins offer the clearest lens on how the invisibility thesis is playing out in practice. The market has concentrated heavily around two issuers: Tether's USDT holds approximately 60 percent market share with a capitalisation exceeding $183 billion, while Circle's USDC holds roughly 25 percent at $73 billion. Together, these two tokens account for over 80 percent of total stablecoin market capitalisation, though that share has declined slightly as competition intensifies.

Tether dominates trading volume, accounting for over 75 percent of stablecoin activity on centralised exchanges. It remains the primary trading pair in emerging markets and maintains higher velocity on exchanges. But USDC has grown faster in 2025, with its market cap climbing 72 percent compared to USDT's 32 percent growth. Analysts attribute this to USDC's better positioning for regulated markets, particularly after USDT faced delistings in Europe due to lack of MiCA authorisation.

Circle's billion-dollar IPO marked the arrival of stablecoin issuers as mainstream financial institutions. The company's aggressive expansion into regulated markets positions USDC as the stablecoin of choice for banks, payment processors, and fintech platforms seeking compliance clarity. This is crypto becoming infrastructure in the most literal sense: a layer enabling transactions that end users never need to understand or acknowledge.

The overall stablecoin supply hit $314 billion in 2025, with the category now comprising 30 percent of all on-chain crypto transaction volume. August 2025 recorded the highest annual volume to date, reaching over $4 trillion for the year, an 83 percent increase on the same period in 2024. Tether alone saw $10 billion in profit in the first three quarters of the year. These are not metrics of a speculative sideshow but of core financial infrastructure.

The emergence of USD1, the stablecoin issued by World Liberty Financial with Trump family involvement, demonstrates how completely stablecoins have departed from crypto's countercultural origins. The token reached $3 billion in circulating supply within six months of launch, integrated with major exchanges including Binance and Tron. Its largest transaction to date, the $2 billion MGX investment in Binance, involved sovereign wealth funds, presidential family businesses, and what senators have alleged are suspicious ties to sanctioned entities. This is not disruption of financial power structures; it is their reconfiguration under blockchain labels.

The GENIUS Act's passage has accelerated this normalisation. By establishing clear regulatory frameworks, the legislation removes uncertainty that previously discouraged traditional financial institutions from engaging with stablecoins. But it also embeds stablecoins within the surveillance and compliance infrastructure that cryptocurrency was originally designed to escape. Issuers must implement anti-money laundering programmes, verify sanctions lists, and identify customers. The anonymous, permissionless transactions that defined early Bitcoin are not merely discouraged but legally prohibited for regulated stablecoin issuers.

The Tokenisation Transformation

Real-world asset tokenisation extends the invisibility thesis from currency into securities. BlackRock's BUIDL fund demonstrated that tokenised treasury assets could attract institutional capital at scale. By year-end 2025, the tokenised RWA market had grown to approximately $33 billion, with the majority concentrated in private credit and US Treasuries representing nearly 90 percent of tokenised value. The market has grown fivefold in two years, crossing from interesting experiment to systemic relevance.